Growth of the Automotive Sector

The The automotive connecting-rod market is set for growth, primarily due to the expansion of the automotive sector in the United States.. With vehicle production projected to reach approximately 17 million units annually, the demand for connecting rods is expected to rise correspondingly. This growth is fueled by a combination of factors, including increased consumer spending, favorable financing options, and a recovering economy. As automakers ramp up production to meet consumer demand, the automotive connecting-rod market is likely to benefit from heightened orders and production schedules. Furthermore, the introduction of new vehicle models and technologies will necessitate the development of advanced connecting rods, further stimulating market growth.

Expansion of Aftermarket Services

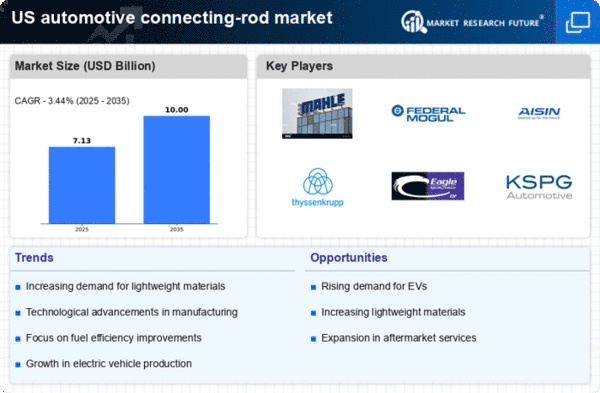

The The automotive connecting-rod market benefits from the growing importance of aftermarket services in the automotive industry.. As vehicle ownership rates rise, the demand for replacement parts, including connecting rods, is expected to grow. This trend is particularly pronounced in the U.S., where a significant portion of vehicles on the road are over five years old. The aftermarket segment is projected to account for a substantial share of the automotive connecting-rod market, as consumers seek reliable and high-quality replacement parts. Additionally, the rise of online retail platforms is facilitating easier access to aftermarket products, further driving growth in this segment.

Rising Demand for Fuel Efficiency

The automotive connecting-rod market is experiencing a notable surge in demand driven by the increasing consumer preference for fuel-efficient vehicles. As fuel prices remain volatile, manufacturers are compelled to innovate and produce lighter, more efficient engines. This trend is reflected in the automotive industry, where the average fuel economy of new vehicles has improved significantly, with a target of 54.5 mpg by 2025. Consequently, the automotive connecting-rod market is adapting to these requirements, as connecting rods play a crucial role in engine performance and efficiency. The focus on reducing vehicle weight and enhancing fuel economy is likely to propel the market forward, as manufacturers seek to meet regulatory standards and consumer expectations.

Technological Innovations in Engine Design

Technological innovations in engine design are significantly impacting the automotive connecting-rod market. As manufacturers strive to enhance engine performance and reduce emissions, the design and materials used in connecting rods are evolving. Advanced computational techniques and simulation tools are enabling engineers to optimize connecting rod designs for strength and weight reduction. This shift towards more sophisticated engineering solutions is likely to result in a more competitive automotive connecting-rod market, as companies that adopt these innovations can offer superior products. The integration of smart technologies in engine management systems may also influence the design of connecting rods, creating opportunities for manufacturers to differentiate their offerings.

Regulatory Compliance and Emission Standards

The The automotive connecting-rod market is increasingly affected by strict regulatory compliance and emission standards. imposed by government agencies. The U.S. Environmental Protection Agency (EPA) has established rigorous guidelines aimed at reducing greenhouse gas emissions from vehicles. As a result, automakers are compelled to invest in technologies that enhance engine efficiency and reduce emissions, which directly impacts the design and manufacturing of connecting rods. This regulatory landscape is likely to drive innovation within the automotive connecting-rod market, as manufacturers seek to develop products that not only comply with regulations but also provide competitive advantages in terms of performance and sustainability.