Military Modernization Programs

The Rotorcraft Blade System Market is significantly influenced by military modernization initiatives across various nations. Governments are investing in upgrading their rotorcraft fleets to enhance operational readiness and capabilities. This includes the procurement of advanced rotorcraft equipped with state-of-the-art blade systems designed for improved maneuverability and combat effectiveness. Market data suggests that defense spending on rotorcraft is expected to increase, with a focus on multi-role capabilities that require sophisticated blade technologies. As military forces seek to maintain strategic advantages, the demand for innovative rotorcraft blade systems is likely to surge.

Advancements in Blade Technology

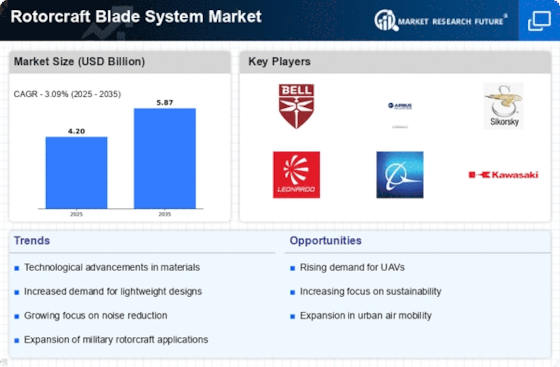

Technological innovations in rotorcraft blade systems are a pivotal driver for the Rotorcraft Blade System Market. Recent developments in materials science, such as the use of composite materials, have led to lighter and more durable blades, enhancing overall rotorcraft performance. Additionally, advancements in aerodynamics and noise reduction technologies are contributing to improved efficiency and reduced environmental impact. The integration of smart technologies, including sensors and monitoring systems, is also gaining traction, allowing for real-time performance assessments. These advancements not only improve operational capabilities but also align with regulatory requirements, thereby fostering market growth.

Growth of Urban Air Mobility Solutions

The Rotorcraft Blade System Market is poised for growth due to the emergence of urban air mobility (UAM) solutions. As cities seek to alleviate congestion and improve transportation efficiency, rotorcraft are being considered as viable options for urban transit. The development of electric vertical takeoff and landing (eVTOL) aircraft is particularly noteworthy, as these vehicles require advanced rotorcraft blade systems to ensure safe and efficient operations. Market forecasts indicate that the UAM sector could generate substantial demand for rotorcraft blade systems, as urban planners and transportation authorities explore innovative solutions to modern mobility challenges.

Increased Demand for Rotorcraft Operations

The Rotorcraft Blade System Market is experiencing heightened demand due to the increasing utilization of rotorcraft in various sectors, including emergency medical services, law enforcement, and search and rescue operations. This trend is driven by the need for rapid response capabilities and the versatility of rotorcraft in accessing remote or challenging terrains. As rotorcraft operations expand, the demand for advanced blade systems that enhance performance and efficiency is likely to rise. Market data indicates that the rotorcraft segment is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years, reflecting the growing reliance on rotorcraft for critical operations.

Regulatory Compliance and Safety Standards

The Rotorcraft Blade System Market is shaped by stringent regulatory frameworks and safety standards imposed by aviation authorities. Compliance with these regulations necessitates the development of advanced rotorcraft blade systems that meet safety and performance criteria. Manufacturers are compelled to invest in research and development to ensure their products align with evolving regulations, which can drive innovation within the industry. Furthermore, adherence to safety standards enhances consumer confidence, potentially leading to increased adoption of rotorcraft for commercial and private use. This regulatory landscape is expected to continue influencing market dynamics in the coming years.

.png)