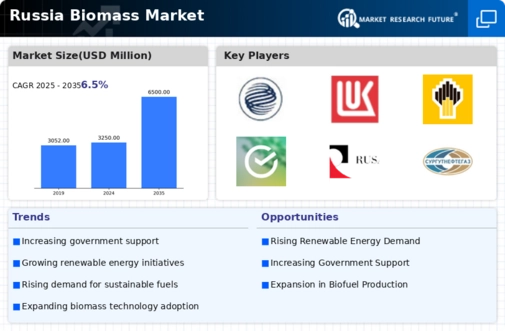

The biomass market in Russia is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as RusBio (RU), Siberian Biomass (RU), and Green Energy (RU) are actively pursuing strategies that emphasize technological advancements and regional expansion. RusBio (RU), for instance, has focused on enhancing its production capabilities through investments in advanced biomass processing technologies, which positions it favorably in a market that is leaning towards efficiency and sustainability. Similarly, Siberian Biomass (RU) has been expanding its operational footprint by establishing new facilities in strategic locations, thereby optimizing its supply chain and enhancing its market reach. Collectively, these strategies indicate a trend towards a more integrated and technologically advanced competitive environment.

In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and improve supply chain efficiency. The market appears moderately fragmented, with several players vying for market share, yet the influence of major companies is palpable. The collective actions of these key players suggest a concerted effort to streamline operations and enhance product offerings, which could lead to a more consolidated market structure in the future.

In November 2025, Green Energy (RU) announced a partnership with a leading technology firm to develop AI-driven solutions for biomass energy management. This strategic move is likely to enhance operational efficiency and reduce costs, positioning Green Energy (RU) as a frontrunner in the integration of digital technologies within the biomass sector. The collaboration underscores the growing importance of technology in optimizing biomass production and distribution processes.

In October 2025, Siberian Biomass (RU) secured a significant contract with a major industrial client to supply biomass pellets for energy generation. This contract not only solidifies Siberian Biomass's (RU) market position but also reflects the increasing demand for renewable energy sources in industrial applications. The strategic importance of this contract lies in its potential to drive revenue growth and enhance the company's reputation as a reliable supplier in the biomass market.

In September 2025, RusBio (RU) launched a new line of eco-friendly biomass products aimed at the residential market. This initiative is indicative of a broader trend towards sustainability and consumer awareness regarding renewable energy sources. By diversifying its product offerings, RusBio (RU) is likely to capture a larger share of the growing residential market, which is becoming increasingly important as consumers seek greener alternatives.

As of December 2025, the competitive trends in the biomass market are heavily influenced by digitalization, sustainability, and the integration of advanced technologies. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to innovate and remain competitive. The shift from price-based competition to a focus on technological differentiation and supply chain reliability is evident. Moving forward, companies that prioritize innovation and sustainability are likely to emerge as leaders in this evolving market.

Leave a Comment