Integration of Advanced Technologies

The Sales Engagement Software Market is being transformed by the integration of advanced technologies such as artificial intelligence and machine learning. These technologies are enhancing the capabilities of sales engagement software, enabling more efficient lead scoring, predictive analytics, and automated follow-ups. The incorporation of AI-driven features allows sales teams to prioritize leads based on their likelihood to convert, thereby optimizing their efforts. As organizations seek to improve their sales processes, the demand for software that harnesses these technologies is likely to increase. This trend suggests a future where sales engagement software not only streamlines operations but also provides actionable insights that can lead to improved sales performance.

Adoption of Omnichannel Sales Strategies

The Sales Engagement Software Market is witnessing a shift towards omnichannel sales strategies. Businesses are increasingly recognizing the need to engage customers across multiple channels, including email, social media, and direct messaging. This trend is driven by the desire to create a seamless customer experience and to meet the diverse preferences of consumers. As a result, sales engagement software that supports omnichannel communication is becoming more prevalent. According to industry reports, the adoption of such strategies is expected to enhance customer satisfaction and loyalty, ultimately leading to increased sales. Companies are investing in software solutions that enable them to manage interactions across various platforms, ensuring that their sales teams can effectively reach and engage potential clients.

Rising Demand for Remote Sales Solutions

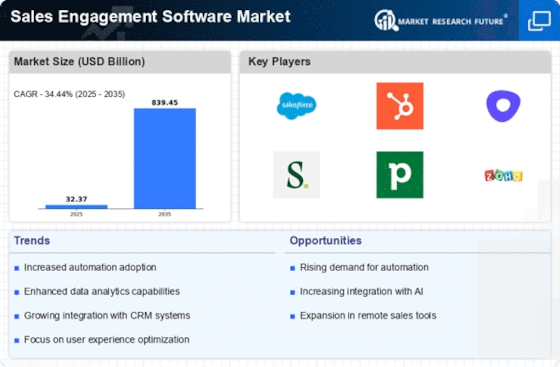

The Sales Engagement Software Market is experiencing a notable increase in demand for remote sales solutions. As organizations continue to adapt to evolving work environments, the need for tools that facilitate remote engagement has surged. According to recent data, the market for sales engagement software is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is driven by the necessity for sales teams to maintain productivity and communication with clients from various locations. Consequently, software that offers features such as video conferencing, virtual collaboration, and real-time analytics is becoming increasingly essential. Companies are investing in these solutions to ensure their sales teams can effectively engage with prospects and customers, thereby enhancing overall sales performance.

Increased Focus on Sales Performance Metrics

In the Sales Engagement Software Market, there is a growing emphasis on the utilization of sales performance metrics. Organizations are increasingly recognizing the importance of data-driven decision-making to optimize their sales strategies. The integration of advanced analytics within sales engagement software allows businesses to track key performance indicators, such as conversion rates and customer engagement levels. This trend is reflected in the market, where the demand for software that provides comprehensive reporting and analytics capabilities is on the rise. By leveraging these insights, sales teams can identify areas for improvement and adjust their approaches accordingly. As a result, companies are likely to see enhanced sales outcomes and improved return on investment.

Growing Importance of Personalization in Sales

Personalization is emerging as a critical driver in the Sales Engagement Software Market. As customers increasingly expect tailored experiences, sales teams are leveraging software that allows for personalized communication and engagement. This trend is supported by data indicating that personalized outreach can significantly improve response rates and customer satisfaction. Sales engagement software that incorporates customer data and insights enables sales professionals to craft messages that resonate with individual prospects. Consequently, organizations are prioritizing investments in solutions that facilitate this level of personalization. By doing so, they aim to enhance their competitive edge and foster stronger relationships with clients, ultimately driving sales growth.