Seed Coating Materials Market Summary

As per Market Research Future analysis, the Seed Coating Materials Market was estimated at 2.437 USD Billion in 2024. The Seed Coating Materials industry is projected to grow from 2.604 USD Billion in 2025 to 5.053 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.85% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Seed Coating Materials Market is experiencing a dynamic shift towards sustainability and technological integration.

- The market is increasingly driven by a focus on sustainability and the adoption of innovative technologies.

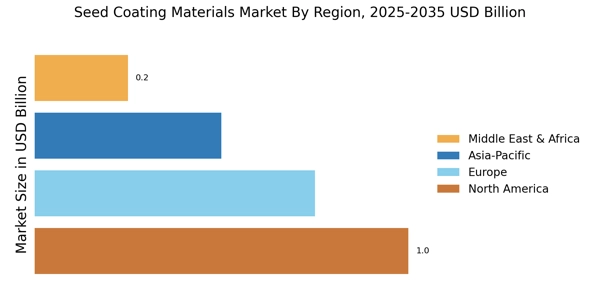

- North America remains the largest market for seed coating materials, while Asia-Pacific is recognized as the fastest-growing region.

- In terms of segments, polymers dominate the market, whereas colorants are emerging as the fastest-growing category.

- Rising demand for high-quality seeds and increased investment in agricultural research are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 2.437 (USD Billion) |

| 2035 Market Size | 5.053 (USD Billion) |

| CAGR (2025 - 2035) | 6.85% |

Major Players

BASF SE (DE), Syngenta AG (CH), Bayer AG (DE), Corteva Agriscience (US), FMC Corporation (US), Nufarm Limited (AU), UPL Limited (IN), KWS SAAT SE (DE)