Rising Incidence of Crop Diseases and Pests

The Seed Treatment Chemical Market is significantly influenced by the rising incidence of crop diseases and pest infestations. As agricultural practices evolve, the threat posed by various pathogens and pests continues to escalate, leading to substantial crop losses. Recent statistics indicate that crop diseases can reduce yields by up to 30% in some regions. Consequently, farmers are increasingly turning to seed treatment chemicals as a preventive measure to protect their crops from these threats. This growing awareness of the importance of seed treatment in disease management is expected to bolster the Seed Treatment Chemical Market, as more farmers recognize the value of investing in effective seed treatments.

Technological Advancements in Seed Treatment

Technological innovations are playing a crucial role in shaping the Seed Treatment Chemical Market. The introduction of precision agriculture techniques, such as seed coating technologies and advanced application methods, enhances the effectiveness of seed treatments. These advancements allow for more targeted application of chemicals, reducing waste and improving crop protection. Furthermore, the integration of data analytics and IoT in agriculture is enabling farmers to make informed decisions regarding seed treatment applications. As a result, the Seed Treatment Chemical Market is likely to witness increased efficiency and productivity, attracting more investments and driving market growth.

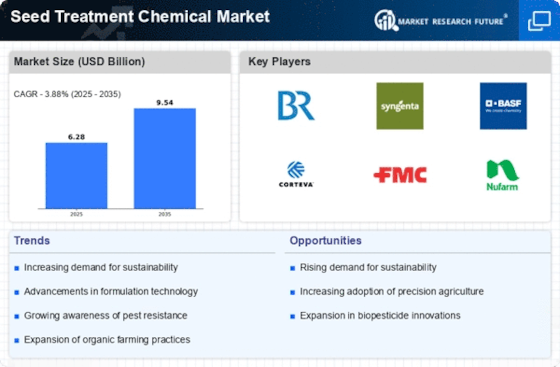

Increasing Demand for Sustainable Agriculture

The Seed Treatment Chemical Market is experiencing a notable shift towards sustainable agricultural practices. Farmers are increasingly adopting seed treatment chemicals that are environmentally friendly and promote soil health. This trend is driven by consumer demand for organic and sustainably produced food, which has led to a rise in the use of biopesticides and biofertilizers. According to recent data, the market for biopesticides is projected to grow at a compound annual growth rate of over 15% in the coming years. This increasing demand for sustainable solutions is likely to propel the Seed Treatment Chemical Market forward, as more agricultural stakeholders seek to minimize their ecological footprint while maximizing crop yields.

Supportive Government Policies and Initiatives

Government policies and initiatives aimed at promoting agricultural productivity are significantly impacting the Seed Treatment Chemical Market. Many governments are implementing programs that encourage the use of seed treatment chemicals to enhance crop yields and ensure food security. These initiatives often include subsidies, research funding, and educational campaigns to inform farmers about the benefits of seed treatments. For instance, certain regions have reported a 20% increase in the adoption of seed treatment chemicals due to government support. Such favorable policies are likely to stimulate growth in the Seed Treatment Chemical Market, as they create a conducive environment for innovation and investment.

Growing Awareness of Seed Quality and Performance

The Seed Treatment Chemical Market is witnessing a surge in awareness regarding the quality and performance of seeds among farmers. As competition in the agricultural sector intensifies, farmers are increasingly recognizing that high-quality seeds treated with effective chemicals can lead to better crop performance and higher yields. This awareness is driving the demand for seed treatment chemicals, as farmers seek to enhance seed vigor and resilience against environmental stresses. Market data suggests that the demand for treated seeds is expected to grow by approximately 10% annually. This trend indicates a promising outlook for the Seed Treatment Chemical Market, as more farmers prioritize seed quality in their agricultural practices.