Growth in Industrial Applications

The Global Selective Catalytic Reduction Market Industry is expanding due to the increasing adoption of SCR technology in various industrial applications, including power generation and manufacturing. Industries are recognizing the importance of reducing nitrogen oxide emissions to meet regulatory requirements and enhance their sustainability profiles. For example, power plants are increasingly integrating SCR systems to comply with environmental standards. This trend is expected to drive market growth, as industries invest in cleaner technologies to mitigate their environmental impact and improve air quality.

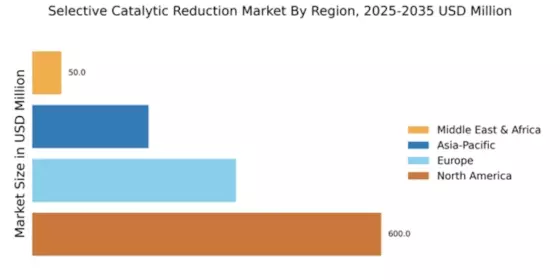

Rising Demand for Diesel Vehicles

The Global Selective Catalytic Reduction Market Industry is bolstered by the increasing demand for diesel vehicles, which are known for their fuel efficiency and lower CO2 emissions compared to gasoline counterparts. This trend is particularly evident in regions such as Europe and Asia, where diesel engines dominate the automotive market. The integration of SCR technology in these vehicles is essential for meeting stringent emission standards. As the automotive sector continues to evolve, the market is expected to grow significantly, with projections indicating a value of 28.1 USD Billion by 2035, driven by the sustained demand for cleaner diesel options.

Increasing Environmental Regulations

The Global Selective Catalytic Reduction Market Industry is experiencing growth due to stringent environmental regulations aimed at reducing nitrogen oxide emissions from vehicles and industrial sources. Governments worldwide are implementing policies that mandate the use of SCR technology in diesel engines, which is crucial for compliance with emission standards. For instance, the European Union's Euro 6 regulations and the United States' EPA standards necessitate the adoption of SCR systems. As a result, the market is projected to reach 15.3 USD Billion in 2024, reflecting the industry's response to these regulatory pressures.

Expansion of Global Automotive Market

The Global Selective Catalytic Reduction Market Industry is significantly impacted by the expansion of the global automotive market, particularly in emerging economies. As countries like India and China experience rapid urbanization and economic growth, the demand for vehicles, especially those equipped with diesel engines, is surging. This growth necessitates the implementation of SCR technology to adhere to evolving emission standards. Consequently, the market is poised for substantial growth, with projections indicating a robust trajectory as manufacturers adapt to the increasing demand for cleaner transportation solutions.

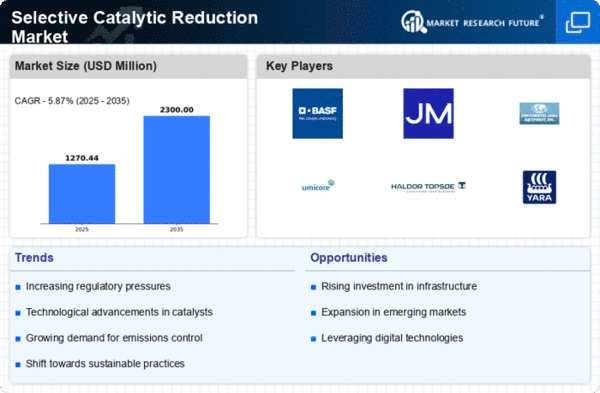

Technological Advancements in SCR Systems

The Global Selective Catalytic Reduction Market Industry is influenced by ongoing technological advancements in SCR systems, which enhance their efficiency and effectiveness. Innovations such as improved catalyst formulations and better system designs contribute to higher performance and lower operational costs. These advancements not only facilitate compliance with emission regulations but also appeal to manufacturers seeking to optimize their production processes. As a result, the market is likely to witness a compound annual growth rate of 5.66% from 2025 to 2035, reflecting the industry's commitment to continuous improvement and innovation.