Cost Efficiency in Production

Cost efficiency remains a critical driver within the Selective Laser Sintering Equipment Market. The technology allows for reduced material waste and shorter production times, which can lead to significant cost savings for manufacturers. By utilizing selective laser sintering, companies can produce parts directly from digital files, minimizing the need for traditional tooling and machining processes. This efficiency is particularly appealing in industries where rapid prototyping and small batch production are essential. Recent market analyses suggest that businesses adopting selective laser sintering can reduce production costs by up to 30%, making it an attractive option for manufacturers looking to optimize their operations and improve their bottom line.

Growing Focus on Sustainability

Sustainability is emerging as a pivotal driver in the Selective Laser Sintering Equipment Market. As environmental concerns gain prominence, manufacturers are increasingly seeking eco-friendly production methods. Selective laser sintering offers a sustainable alternative by minimizing waste and enabling the use of recyclable materials. This aligns with the broader industry trend towards sustainable manufacturing practices. Market Research Future suggest that companies adopting selective laser sintering can achieve a reduction in carbon footprint by up to 40% compared to conventional manufacturing methods. This focus on sustainability not only meets regulatory requirements but also appeals to environmentally conscious consumers, further driving the demand for selective laser sintering technologies.

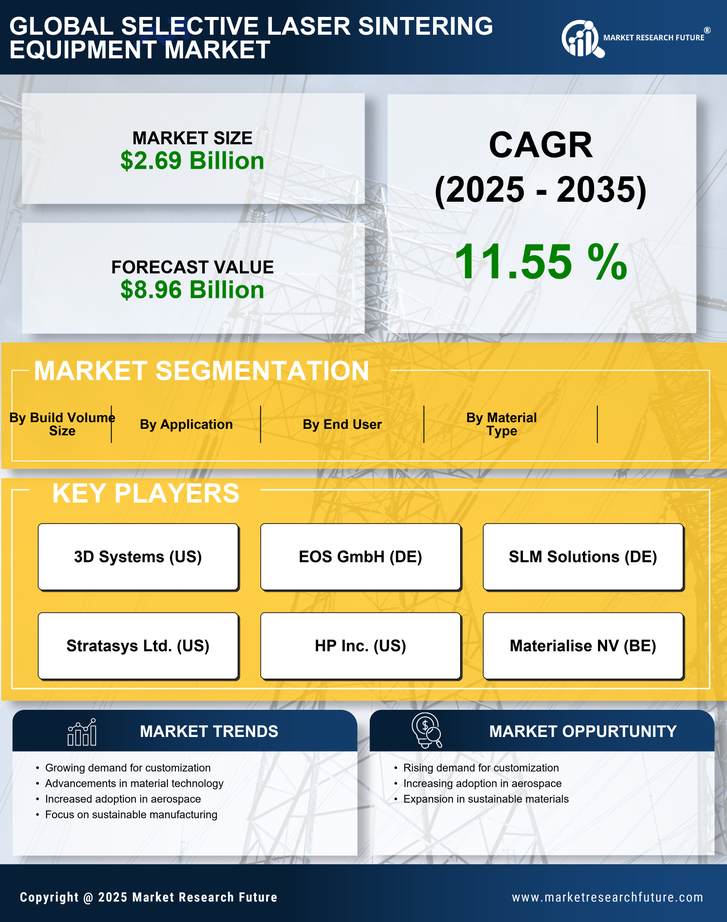

Rising Demand for Customization

The Selective Laser Sintering Equipment Market is experiencing a notable increase in demand for customized products across various sectors, including aerospace, automotive, and healthcare. This trend is driven by the growing need for tailored solutions that meet specific customer requirements. As industries seek to differentiate their offerings, the ability to produce complex geometries and unique designs through selective laser sintering becomes increasingly valuable. Market data indicates that the customization segment is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This shift towards personalization not only enhances customer satisfaction but also drives manufacturers to invest in advanced selective laser sintering technologies, thereby propelling the overall market forward.

Advancements in Material Science

The Selective Laser Sintering Equipment Market is significantly influenced by advancements in material science. The development of new materials specifically designed for selective laser sintering, such as high-performance polymers and metal powders, expands the range of applications for this technology. These innovations enable the production of parts with enhanced mechanical properties, thermal resistance, and overall performance. As industries increasingly adopt selective laser sintering for functional end-use parts, the demand for compatible materials is expected to rise. Market forecasts indicate that the materials segment within the selective laser sintering market could witness a growth rate of around 20% in the coming years, reflecting the importance of material advancements in driving market expansion.

Increased Adoption in Aerospace and Automotive Sectors

The aerospace and automotive sectors are becoming key drivers of growth in the Selective Laser Sintering Equipment Market. These industries are leveraging selective laser sintering for its ability to produce lightweight, complex components that meet stringent regulatory standards. The technology facilitates rapid prototyping and the production of end-use parts, which is crucial in the fast-paced environment of aerospace and automotive manufacturing. Recent reports indicate that the adoption of selective laser sintering in these sectors is expected to increase by approximately 30% over the next few years, as companies seek to enhance performance and reduce weight in their products. This trend underscores the technology's potential to revolutionize traditional manufacturing processes.