Market Share

Sentinel Node Biopsy Market Share Analysis

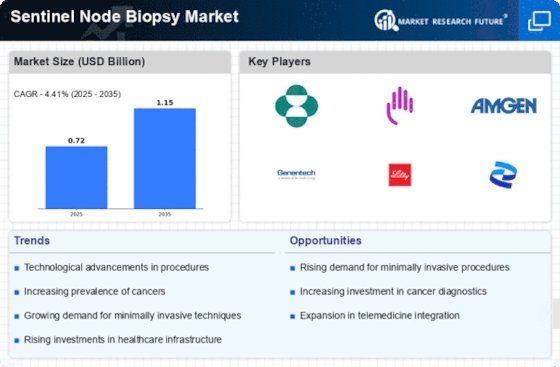

Effective marketplace percentage positioning in the Sentinel Node Biopsy (SNB) market starts with a complete expertise of the marketplace dynamics. Factors that include evolving surgical techniques, technological advancements, and the increasing occurrence of situations requiring SNB have an impact on businesses' techniques in this aggressive panorama. Collaborations with healthcare establishments and surgical facilities are crucial for market proportion positioning. Companies forge partnerships to ensure that their SNB technology is accessible to a wide range of scientific experts. These collaborations also function as systems for actual global application, fostering trust in the efficacy of their products. Elevating awareness amongst sufferers about the advantages and significance of SNB is a pivotal aspect of market positioning. Expansion into untapped worldwide markets is a method employed by agencies looking to grow their market share in SNB. Recognizing the global demand for advanced surgical procedures, those businesses tailor their products and advertising and marketing strategies to fulfill the particular needs of various areas, fostering a worldwide boom. Market leaders in SNB recognize the numerous applications of this approach across diverse scientific conditions. Tailoring their products to cope with precise scientific specialties and situations positions them as professionals in areas of interest markets, allowing them to capture a tremendous proportion of the general SNB panorama. Offering fee-effective solutions without compromising fines is a concern for groups in the SNB marketplace. Ensuring accessibility by catering to special financial constraints enhances market penetration. Adherence to stringent regulatory requirements and a dedication to maintaining extremely good merchandise are vital within the SNB market. Companies that prioritize regulatory compliance and invest in high-quality assurance measures build trust among healthcare experts and contribute to a high-quality marketplace belief. Recognizing the importance of facts in healthcare, organizations recognize developing SNB solutions that integrate seamlessly with digital fitness facts and other healthcare structures. Enhanced connectivity no longer improves efficiency in affected person care but additionally positions the employer as a contributor to the wider healthcare environment.

Leave a Comment