Research Methodology on Liquid Biopsy Market Overview

Introduction

The research methodology for the “Liquid Biopsy Market - Global Analysis and Forecasts” report is presented in this section. This research aims to provide in-depth insights into the global liquid biopsy market, by analyzing its current and projected performance concerning competitive market forces. This report provides an overview of the industry, market drivers and inhibitors influencing the market growth, competitive dynamics and key chapters of the market in terms of market segmentation and applications.

Research Approach

In order to collect information on market trends, drivers and inhibitors, the research process includes extrapolating the data and insights derived from second-party resources such as published reports, corporate websites, and public datasets. The prognosis of the global liquid biopsy market is established by balancing the vital qualitative and quantitative information which is obtained through primary interviews with Market Experts and Thought Leaders, as well as via extensive literature reviews including secondary sources such as directories, industry journals, white papers, technical papers, press releases, corporate annual reports from top players.

Moreover, market forecasts and projections are established by using advanced econometric techniques and models. The research process is divided into five sections – Primary & Secondary Exploration, Mapping of Market Opportunities, Market Assessments & Projections and Validation of Model Assumptions.

Scope of the Report

The report includes the landscape of the global liquid biopsy market, its size by value, by region and by end-user, competitive landscape and competitive strategies adopted by key players, market dynamics such as drivers, restraints, opportunities and challenges, new technological advancements and recent launches and future market trends. The notable market players included in the report comprise Genomic Health Inc., Life Technologies Corporation, Biocept Inc., Biodesix Inc., Cepheid, Cynvenio Biosystems Inc., Exosome Life Sciences, HTG, MDxHealth Ltd., Myriad Genetics Inc., and Trovagene Inc. In all, 17 company profiles have been included in the report.

Research Methodology

The research methodology for the liquid biopsy market is based on both primary and secondary research. For the primary research, a structured questionnaire is sent to industry experts, including key opinion leaders and thought leaders, who provided their insights and views on the market. In addition, macro- and micro-economic indicators of the industry are considered for arriving at the expected market growth during the forecast period. The secondary research is done using extensive research methodologies and in-depth analysis of published market reports and content from paid databases, journals and other third-party resources. The market data is also validated with proprietary analytics tools and models.

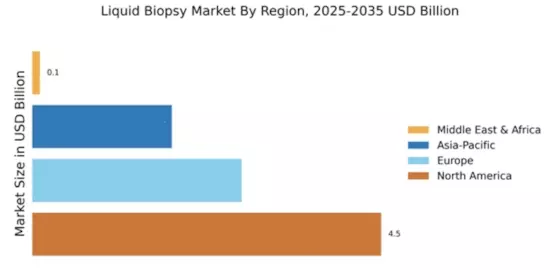

The market is segmented into product types, applications, end-users, geographies and key countries and stakeholders. Primary interviews are conducted to ascertain the market estimates and confirm the assumptions based on secondary and primary research. The report covers a geographic segmentation of the liquid biopsy market along with competitor analysis for key countries/regions such as North America (US, Canada, Mexico and the Rest of North America), Europe (The UK, Germany, France, Rest of Europe), Asia-Pacific (India, China, Japan, Rest of Asia Pacific) and Rest of the world (Middle East & Africa, Latin America).

Market Estimation

The global liquid biopsy market is estimated considering historical data and various market dynamics such as market drivers, opportunities and challenges. Thereafter, calculated values have been derived through an exhaustive triangulation method. All these factors are studied, analyzed, considered and weighted to arrive at the estimated values, which help to forecast the market position in terms of CAGR, size and other important parameters.

Data Sources

The data points considered to come up with the market estimates and forecasts include secondary research, databases and primary research (which includes interviews and surveys). The data points were aggregated and the resultant values were checked and validated using proprietary analytics models.

Customization

The report can be customized as per the requirements of the clients. Based on detailed analysis and insights into the market, customized deliveries on the research report are provided including company-specific analysis, regional-specific analysis and segment-specific analysis.