Rising Incidence of Cancer

The increasing incidence of cancer in South America is a primary driver for the liquid biopsy market. According to recent statistics, cancer cases are projected to rise by approximately 20% over the next decade in the region. This alarming trend necessitates innovative diagnostic solutions, such as liquid biopsies, which offer non-invasive testing options. Liquid biopsies can detect circulating tumor DNA (ctDNA) and other biomarkers, enabling early diagnosis and personalized treatment plans. As healthcare providers seek to improve patient outcomes, the demand for liquid biopsy technologies is expected to surge. Furthermore, the liquid biopsy market is likely to benefit from collaborations between research institutions and healthcare organizations aimed at developing advanced diagnostic tools tailored to the unique needs of the South American population.

Regulatory Framework Enhancements

Enhancements in the regulatory framework surrounding diagnostic tools are fostering growth in the liquid biopsy market in South America. Regulatory bodies are increasingly recognizing the importance of liquid biopsies as viable diagnostic options, leading to streamlined approval processes for new technologies. This supportive environment encourages innovation and investment in the development of liquid biopsy solutions. Countries like Chile and Colombia are actively working to establish clear guidelines for the use of liquid biopsies in clinical practice, which could further stimulate market growth. As regulatory frameworks become more conducive to the adoption of these technologies, the liquid biopsy market is expected to flourish, potentially reaching a market size of $500 million by 2028.

Investment in Healthcare Infrastructure

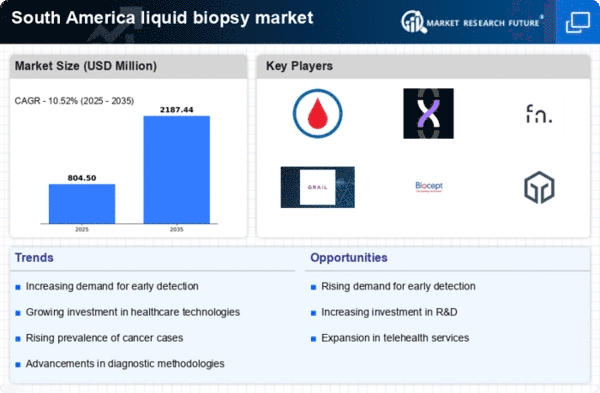

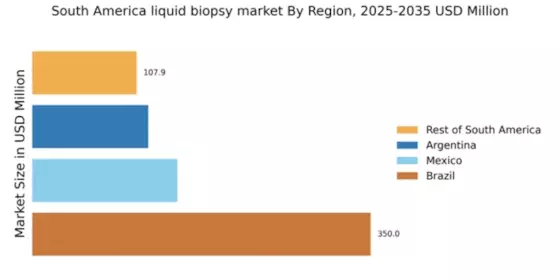

Investment in healthcare infrastructure across South America is significantly influencing the liquid biopsy market. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, which includes the integration of advanced diagnostic technologies. For instance, Brazil and Argentina have initiated programs to modernize laboratories and improve access to cutting-edge diagnostic tools. This investment is expected to facilitate the adoption of liquid biopsy technologies, as healthcare providers will have the necessary resources to implement these innovative solutions. The liquid biopsy market could see a compound annual growth rate (CAGR) of around 15% in the coming years, driven by improved healthcare infrastructure and increased accessibility to diagnostic services.

Growing Demand for Personalized Medicine

The shift towards personalized medicine in South America is a significant driver for the liquid biopsy market. As healthcare professionals increasingly recognize the importance of tailoring treatments to individual patients, liquid biopsies provide a valuable tool for monitoring treatment responses and detecting disease recurrence. This approach not only enhances patient care but also aligns with the broader trend of precision medicine. The liquid biopsy market is expected to expand as more healthcare providers adopt these technologies to facilitate personalized treatment plans. Market analysts predict that the demand for personalized medicine could lead to a 25% increase in liquid biopsy utilization over the next five years, reflecting a growing commitment to individualized patient care.

Technological Innovations in Diagnostic Tools

Technological innovations in diagnostic tools are propelling the liquid biopsy market forward in South America. Advances in sequencing technologies, bioinformatics, and data analysis are enhancing the accuracy and efficiency of liquid biopsies. For example, the development of next-generation sequencing (NGS) has revolutionized the ability to analyze ctDNA and other biomarkers from blood samples. This progress not only improves diagnostic capabilities but also reduces turnaround times for results, making liquid biopsies more appealing to healthcare providers. As these technologies continue to evolve, the liquid biopsy market is likely to experience substantial growth, with projections indicating a potential market value increase of up to $1 billion by 2030.