Advancements in Pharmacological Research

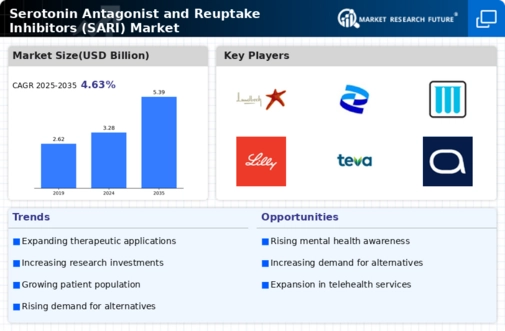

Innovations in pharmacological research are significantly influencing the Serotonin Antagonist and Reuptake Inhibitors (SARI) Market. Recent studies have focused on the development of novel compounds that target serotonin receptors more effectively, leading to improved therapeutic outcomes. The introduction of new SARI formulations, which may offer enhanced efficacy and reduced side effects, is expected to attract both healthcare providers and patients. Additionally, the exploration of combination therapies that incorporate SARI with other classes of antidepressants could further broaden treatment options. Market data indicates that The Serotonin Antagonist and Reuptake Inhibitors (SARI) is projected to reach substantial figures, with SARIs playing a pivotal role in this growth. As research continues to unveil the complexities of serotonin pathways, the SARI market is poised for expansion, driven by the demand for innovative and effective mental health treatments.

Growing Acceptance of Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the Serotonin Antagonist and Reuptake Inhibitors (SARI) Market. As healthcare providers increasingly recognize that mental health treatments must be tailored to individual patient needs, there is a growing demand for SARIs that can be customized based on genetic and biochemical profiles. This trend is supported by advancements in pharmacogenomics, which allow for more precise treatment strategies. Market data suggests that personalized medicine is expected to capture a significant share of the pharmaceutical market, with mental health treatments being a key focus area. The ability to offer targeted therapies that minimize side effects and maximize efficacy could enhance patient adherence to treatment regimens. Consequently, the SARI market may experience growth as healthcare systems adopt more personalized approaches to mental health care.

Rising Investment in Mental Health Initiatives

Increased investment in mental health initiatives is a notable driver for the Serotonin Antagonist and Reuptake Inhibitors (SARI) Market. Governments and private organizations are recognizing the economic and social impact of untreated mental health disorders, leading to enhanced funding for research, treatment programs, and public awareness campaigns. This influx of investment is likely to facilitate the development of new SARI medications and improve access to existing treatments. Furthermore, as mental health becomes a priority on national health agendas, there is potential for expanded insurance coverage for SARI medications, making them more accessible to patients. The growing emphasis on mental health is expected to create a more favorable market environment for SARIs, ultimately benefiting both patients and healthcare providers.

Regulatory Support for Mental Health Treatments

Regulatory bodies are increasingly supporting the development and approval of mental health treatments, which is a crucial driver for the Serotonin Antagonist and Reuptake Inhibitors (SARI) Market. Recent initiatives aimed at expediting the approval process for new psychiatric medications have created a more favorable environment for pharmaceutical companies. This regulatory support is particularly important for SARIs, as they are often used in complex treatment regimens for various mental health disorders. The potential for faster market entry of new SARI products may enhance competition and drive innovation within the industry. Furthermore, as regulatory agencies emphasize the importance of mental health, there is a growing likelihood of increased funding for research and development in this area. This trend could lead to a more robust pipeline of SARI medications, ultimately benefiting patients and healthcare providers alike.

Increasing Prevalence of Mental Health Disorders

The rising incidence of mental health disorders, such as depression and anxiety, is a primary driver for the Serotonin Antagonist and Reuptake Inhibitors (SARI) Market. According to recent estimates, nearly one in five adults experiences mental illness annually, leading to a growing demand for effective treatment options. This trend is particularly evident in developed regions, where healthcare systems are increasingly prioritizing mental health. The increasing recognition of mental health as a critical component of overall well-being has prompted healthcare providers to seek innovative pharmacological solutions. As a result, the SARI market is likely to expand, driven by the need for medications that address complex neurochemical imbalances. Furthermore, the integration of mental health services into primary care settings may further enhance the visibility and accessibility of SARI medications, potentially increasing their adoption among patients.