Rising Prevalence of Diabetes

The increasing incidence of diabetes worldwide is a primary driver for the Short Acting Insulin Market. According to recent estimates, the number of individuals diagnosed with diabetes is projected to reach approximately 700 million by 2045. This surge in diabetes cases necessitates effective management strategies, including the use of short acting insulin. As healthcare systems adapt to this growing challenge, the demand for short acting insulin is likely to rise, as it provides rapid glucose control for patients. Furthermore, the rising prevalence of obesity, a significant risk factor for type 2 diabetes, further exacerbates this trend. Consequently, the Short Acting Insulin Market is expected to experience substantial growth as healthcare providers seek to offer timely and effective treatment options for diabetes management.

Advancements in Insulin Formulations

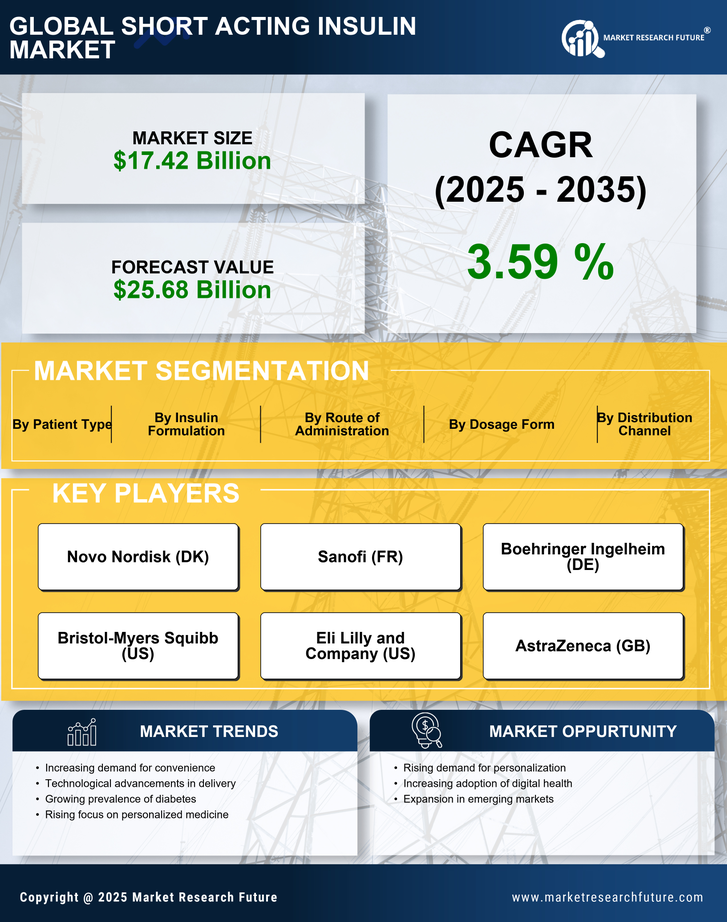

Innovations in insulin formulations are significantly influencing the Short Acting Insulin Market. Recent developments have led to the creation of more effective and user-friendly insulin products, enhancing patient adherence to treatment regimens. For instance, the introduction of ultra-rapid acting insulins has improved glycemic control, allowing for more flexibility in meal timing. These advancements not only cater to the needs of patients but also align with the evolving landscape of diabetes care. Market data indicates that the short acting insulin segment is expected to witness a compound annual growth rate (CAGR) of around 8% over the next five years. This growth is indicative of the increasing acceptance of innovative insulin formulations among healthcare professionals and patients alike, thereby driving the Short Acting Insulin Market forward.

Increased Focus on Preventive Healthcare

The heightened emphasis on preventive healthcare is shaping the Short Acting Insulin Market. As awareness of diabetes and its complications rises, there is a concerted effort to promote early intervention and effective management strategies. This shift is reflected in healthcare policies that prioritize preventive measures, including regular screening and timely access to insulin therapy. The integration of short acting insulin into preventive care protocols is becoming more common, as it allows for immediate glucose control in patients at risk of hyperglycemia. Consequently, the Short Acting Insulin Market is likely to benefit from this trend, as healthcare systems increasingly recognize the value of proactive diabetes management in reducing long-term complications and healthcare costs.

Regulatory Support for Diabetes Treatments

Regulatory support for diabetes treatments is a significant driver for the Short Acting Insulin Market. Governments and health authorities are increasingly recognizing the need for accessible and effective diabetes management options. This has led to streamlined approval processes for new insulin formulations and delivery systems, facilitating quicker market entry for innovative products. Additionally, reimbursement policies are evolving to support the use of short acting insulin, making it more accessible to patients. Market data indicates that favorable regulatory environments are likely to enhance the growth prospects of the short acting insulin segment. As a result, the Short Acting Insulin Market is expected to thrive, driven by supportive regulatory frameworks that encourage the development and adoption of advanced diabetes therapies.

Growing Demand for Diabetes Management Solutions

The escalating demand for effective diabetes management solutions is a crucial driver for the Short Acting Insulin Market. As healthcare providers and patients alike seek to optimize diabetes care, short acting insulin has emerged as a vital component of treatment plans. The market is witnessing a shift towards integrated diabetes management systems that combine insulin therapy with continuous glucose monitoring and digital health tools. This trend is supported by the increasing recognition of the importance of personalized treatment approaches. Market analysis suggests that the short acting insulin segment will continue to expand as patients and healthcare providers prioritize comprehensive diabetes management solutions. The Short Acting Insulin Market is thus positioned to benefit from this growing demand, as it aligns with the broader movement towards holistic healthcare.