Aging Population

The aging population is a primary driver of the Short-Term Care Insurance Market. As life expectancy increases, a larger segment of the population requires assistance with daily activities, leading to a heightened demand for short-term care solutions. According to recent statistics, individuals aged 65 and older are projected to double by 2050, which could significantly impact the market. This demographic shift necessitates the development of tailored insurance products that cater to the unique needs of older adults. Furthermore, the rising prevalence of chronic conditions among this age group amplifies the need for short-term care services, thereby driving growth in the Short-Term Care Insurance Market. Insurers are likely to respond by expanding their offerings to include more comprehensive short-term care options.

Rising Healthcare Costs

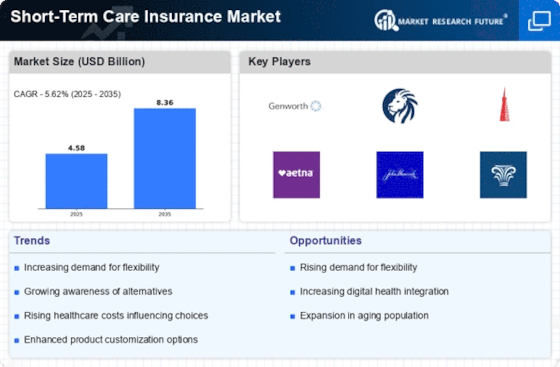

Rising healthcare costs are a crucial factor influencing the Short-Term Care Insurance Market. As medical expenses continue to escalate, individuals are increasingly seeking insurance solutions that can alleviate the financial burden associated with short-term care. Data indicates that healthcare spending is expected to reach unprecedented levels, prompting consumers to consider short-term care insurance as a viable option. This trend is particularly evident among middle-aged individuals who are planning for potential future care needs. The Short-Term Care Insurance Market is likely to see a surge in demand as consumers recognize the importance of financial protection against high healthcare costs. Insurers may respond by offering more competitive pricing and flexible policy options to attract a broader customer base.

Changing Family Dynamics

Changing family dynamics are influencing the Short-Term Care Insurance Market in notable ways. With more families becoming geographically dispersed and traditional caregiving roles evolving, individuals are increasingly reliant on professional short-term care services. This shift is prompting a greater awareness of the need for insurance coverage that addresses short-term care needs. As family structures change, the demand for flexible and comprehensive short-term care insurance policies is likely to rise. The Short-Term Care Insurance Market may respond by offering products that cater to diverse family situations, ensuring that individuals have access to the care they require, regardless of their family circumstances. This trend highlights the importance of adapting insurance offerings to meet the evolving needs of consumers.

Technological Advancements

Technological advancements are playing a pivotal role in the evolution of the Short-Term Care Insurance Market. Innovations in telehealth, remote monitoring, and health management applications are transforming how care is delivered and managed. These technologies not only enhance the quality of care but also improve the efficiency of service delivery, making short-term care more accessible. As consumers become more tech-savvy, they are likely to seek insurance products that integrate these advancements. The Short-Term Care Insurance Market may witness increased competition as insurers leverage technology to differentiate their offerings. Furthermore, the integration of data analytics can help insurers better understand consumer needs, leading to more personalized policy options.

Increased Focus on Preventive Care

The increased focus on preventive care is reshaping the Short-Term Care Insurance Market. As healthcare systems worldwide emphasize preventive measures, individuals are becoming more aware of the importance of maintaining their health and well-being. This shift encourages consumers to invest in short-term care insurance as a proactive approach to managing potential health issues. Preventive care initiatives, such as regular health screenings and wellness programs, may reduce the need for extensive long-term care, thereby influencing the demand for short-term care solutions. The Short-Term Care Insurance Market could benefit from this trend as insurers develop policies that align with preventive care strategies, potentially leading to lower premiums and improved health outcomes for policyholders.