Advancements in Technology

The Simulators Market is experiencing a surge due to rapid advancements in technology. Innovations in artificial intelligence, machine learning, and graphics rendering are enhancing the realism and interactivity of simulators. For instance, the integration of high-definition graphics and real-time data processing allows for more immersive experiences. This technological evolution is not only attracting new users but also expanding the applications of simulators across various sectors, including aviation, healthcare, and military training. As a result, the market is projected to grow at a compound annual growth rate of approximately 15% over the next five years, indicating a robust demand for sophisticated simulation solutions.

Rising Adoption in Entertainment

The Simulators Market is significantly influenced by the rising adoption of simulators in the entertainment sector. With the proliferation of gaming and virtual reality experiences, consumers are increasingly seeking immersive entertainment options. This trend is evident in the popularity of racing and flight simulation games, which have gained substantial traction among gamers. Furthermore, theme parks and entertainment venues are incorporating advanced simulators to enhance visitor experiences, creating a new revenue stream. The entertainment segment is projected to account for a considerable share of the market, potentially exceeding 30% by 2025, reflecting the growing consumer appetite for engaging and interactive experiences.

Focus on Safety and Risk Management

The Simulators Market is also driven by a heightened focus on safety and risk management across various industries. Organizations are increasingly utilizing simulators to conduct risk assessments and safety training, particularly in high-stakes environments such as oil and gas, construction, and aviation. By simulating hazardous scenarios, companies can prepare their workforce to respond effectively to emergencies, thereby reducing the likelihood of accidents. This proactive approach to safety is likely to propel the demand for simulation technologies, as businesses seek to comply with regulatory standards and enhance operational safety. The market for safety-related simulators is expected to grow substantially, reflecting the critical importance of risk management.

Emerging Markets and Economic Growth

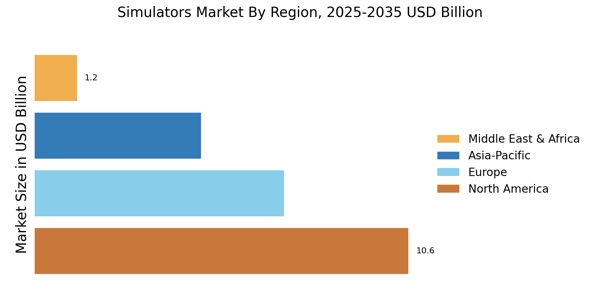

The Simulators Market is poised for growth due to emerging markets and overall economic development. As economies in regions such as Asia and Latin America continue to expand, there is a growing investment in training and simulation technologies. These regions are increasingly adopting simulators for various applications, including education, military training, and industrial operations. The rising middle class and increased spending power are contributing to the demand for advanced training solutions. Consequently, the market is likely to see a significant influx of investments, with projections indicating a potential doubling of market size in these emerging economies over the next decade.

Increased Demand for Training Solutions

The Simulators Market is witnessing increased demand for effective training solutions across multiple sectors. Organizations are recognizing the value of simulation-based training as it offers a safe and controlled environment for skill development. For example, in the aviation sector, flight simulators are essential for pilot training, allowing for the practice of emergency procedures without real-world risks. The healthcare industry is also leveraging simulators for medical training, where practitioners can hone their skills on virtual patients. This growing emphasis on experiential learning is expected to drive the market, with estimates suggesting a market size reaching several billion dollars by 2026.