Market Analysis

In-depth Analysis of Single Use Bioprocessing Market Industry Landscape

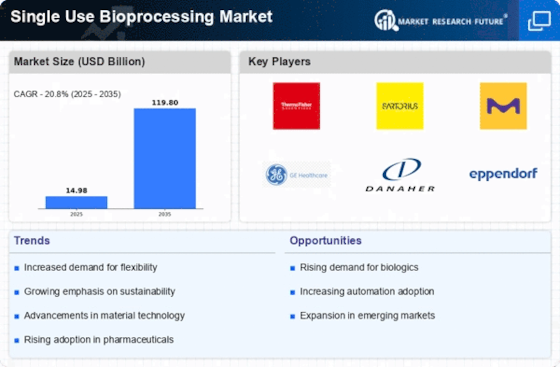

The market for single-use biopossessing especially is a sophisticated and expanding sector, in a trade where disposable technologies are being adapted at various levels of bioproduction. Single-use bioprocessing marketplace is pressured by many points that include both low cost efficiency as well as pressures for higher flexibility and more demand for biopharmaceuticals.

The transformation of single use bioprocessing market is based on the requirements of cost-effectiveness and performance in the pharmaceutical production on one side and the necessity of flexibility in the technology on the other side. An ordinary stainless-steel structure is accompanied by pre-investments for the infrastructure, cleaning, and the sanitation validation. Meanwhile, contrary to their reusable counterparts represented by those disposable bioreactors, mixers, and connectors, single use systems offer a quicker and cheaper method. Easier and faster cleanings (without the dry runs) allow for accelerating appointment times and for manufacturers to maneuver in the markets.

Scalability of single-use technology in bioprocesses therefore is another significant aspect for the market demand. This flexibility allows the biopharmaceutical manufacturing industry to move the production up and down based on demand. Historically, this had to be done in fixed stainless steel facilities with high capital investment and operational risk. The scalability together with the industry-specific requirements goes hand in hand, with biopharmaceutical production often being on a different scale, ranging from the laboratory research to full scale as well as commercial production levels.

Shaダ ts of technological advancement and developments change bioprocessing market to the single use one. The constant development in the materials, design, and manufacturing processes of disposable bioprocessing components lead to an improvement in the workhorse of these elements. This perpetual innovation also assists the wider adoption of single-use technology in biopharmaceutical manufacturing, where companies that wants to have so-called cutting edge methods to improve efficiency may move.

The tendency is towards seeking more biopharmaceutical products, including monoclonal antibodies, vaccines, and gene treatments. With the extent of biopharmaceutical pipelines growing, manufacturers are straining to increase their production capacity whilst simultaneously managing the cost effectiveness and compromises. These disposable bioprocessing technologies are uniquely tuned to meet this needby providing a compact and easy way for bioreactors, ratherthanmastering a highly complex system which would require lengthy time goals,single-use bioprocesses allow industries the advantage of flexibly changing production batches in a short span of time.

The competitive atmosphere of the disposable bioprocessing market is fuelled by the mix of stronghold of the bioprocessing companies, the emerging startups and the partnership trails between the companies. The mergers and acquisitions start to lead to market concentration when big companies (with bigger financial powers) buy disruptive innovations to improve their product catalogue. The relationship between equipment manufacturers and biopharmaceutical company frog已经促进了开发,专为单次使用测试,让制药行业的需求选择根据应用的具体性调整。这个关系影响了市场行情。

Leave a Comment