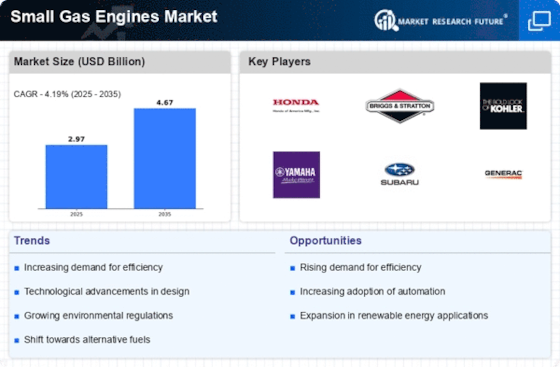

Market Share

Introduction: Navigating the Competitive Landscape of Small Gas Engines

Small gas engines are going through a period of change. The introduction of new technology and changing legislation are driving change. The main players in the market, such as the engine manufacturers, IT service providers and equipment suppliers, are competing for market leadership by deploying advanced technology such as artificial intelligence-based analysis and IoT integration. The engine manufacturers are focusing on improving the performance of the engine and reducing emissions. The IT service companies are developing smart solutions to optimize engine management. The equipment suppliers are focusing on reducing costs and improving productivity. The new entrants, especially the green energy and automation companies, are challenging the established business models and forcing the main players to be more creative. Strategic deployment will be based on the need to meet the requirements for green energy and operational efficiency in the local market. The combination of these forces will determine the future competition, and the C-level managers need to be able to respond quickly to the technological changes and the market changes.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across various segments of the small gas engines market.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Briggs and Straton Corporation | Strong brand recognition and reliability | Small engine manufacturing | North America, Europe |

| Honda Motor Co. | Innovative technology and fuel efficiency | Gasoline engines and power equipment | Global |

| Kohler Co. | Diverse product range and customization | Engines and power systems | North America, Europe, Asia |

| Kawasaki Heavy Industries | High-performance engineering expertise | Small engines and machinery | Global |

| Yamaha Motor Co. | Strong focus on innovation and design | Engines and recreational products | Global |

Specialized Technology Vendors

These vendors focus on niche technologies and solutions within the small gas engines market.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Liquid Combustion Technology LLC. | Advanced combustion technology | Engine efficiency solutions | North America, Europe |

| Champion Power Equipment | Affordable and reliable power solutions | Portable generators and engines | North America |

| Fuzhou Launtop M&E Co. Ltd. | Cost-effective manufacturing capabilities | Small engine production | Asia, emerging markets |

| Maruyama Mfg. Co. Inc. | Specialized in outdoor power equipment | Professional-grade engines | North America, Asia |

| Lifan Power | Strong presence in emerging markets | Small engine and generator sets | Asia, Africa |

Infrastructure & Equipment Providers

These vendors provide essential equipment and infrastructure to support small gas engine applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Kubota Corporation | Robust agricultural and industrial solutions | Engines and machinery | Global |

| Fuji Heavy Industries | Diverse engineering capabilities | Engine and vehicle systems | Asia, North America |

Emerging Players & Regional Champions

- Ecopower Engines (USA): specializes in the production of small engines with low emissions, recently securing a contract with a major landscaper for their electric-start engines, and aims to compete with the established suppliers by focusing on the environment and a compliance with stricter regulations.

- GreenTech Motors, Germany: GreenTech Motors has developed a new small-engine concept that combines gas and electricity. They recently conducted a trial with a local municipality to maintain the parks. The new technology complements existing products by providing a more versatile solution for urban applications.

- AeroGas (Canada) – specializes in the production of light and small gas engines for drones and UAVs. The company has recently entered into a partnership with a new company in the field of drone delivery. Its aim is to challenge the established players by capturing the growing market for drones and focusing on performance and efficiency.

- Powermax Innovations (India): Develops small, cheap gas engines for agricultural applications, recently received a contract from the government to supply engines for agricultural machinery in the rural areas, thereby complementing established suppliers in the price-sensitive segment of the market.

Regional Trends: In 2024, the market for small gasoline engines is undergoing a strong trend towards greater environmental friendliness and compliance with regulations, especially in North America and Europe, where the regulations are becoming more and more severe. In addition, there is a growing demand for hybrid and electric solutions, especially in cities. Emerging companies are focusing on special applications, such as drones and agricultural machinery, which makes it possible to enter new markets and challenge the established players.

Collaborations & M&A Movements

- Briggs & Stratton and Kohler Co. entered into a partnership to co-develop eco-friendly small gas engines, aiming to capture the growing demand for sustainable power solutions in the outdoor equipment sector.

- Honda Motor Co. acquired a minority stake in a startup focused on electric small engine technology, positioning itself to diversify its product offerings amid increasing regulatory pressures for emissions reductions.

- Yamaha Motor Co. and Subaru Corporation announced a collaboration to enhance the performance and efficiency of small gas engines, strengthening their competitive positioning in the recreational vehicle market.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Fuel Efficiency | Honda, Briggs & Stratton | Honda has been able to increase the fuel efficiency of its small engines by up to 20 per cent, compared with the old carburettor type. Briggs & Stratton has launched a range of improved-combustion engines, which have been very well received in the lawnmower and garden equipment industries. |

| Emissions Control | Kohler, Yamaha | A new, advanced system of catalytic converters is employed in all of our engines, thereby reducing emissions to the minimum required by EPA regulations. This technology has proven particularly popular in the marine industry, where the environment is a major concern. |

| Durability and Reliability | Generac, Tecumseh | The Generac small gas engines are known for their ruggedness and long life, and are used in standby power applications. These engines are also known for their long life, and are often used in difficult applications. |

| Noise Reduction | Husqvarna, Echo | Husqvarna has developed a series of small gasoline engines with noise reduction technology, which are suitable for use in the home. Echo engines are also designed with noise reduction in mind, and have been especially effective in applications where noise regulations are strict. |

| Smart Technology Integration | Briggs & Stratton, Honda | IoT-capable engines from Briggs & Stratton are now available for remote monitoring and diagnostics. Honda’s smart engines optimize performance and maintenance, and appeal to tech-savvy consumers. |

Conclusion: Navigating the Small Gas Engines Landscape

The market for small gas engines is characterized by a high degree of fragmentation. Several large and small companies are vying for market share. The trends in the region are showing an increasing focus on environment and regulations, which is driving suppliers to innovate and adapt their products. The companies with a long history in the market are able to use brand loyalty and their distribution network to their advantage. New entrants are focusing on advanced capabilities such as artificial intelligence and automation to differentiate themselves. In the future, the ability to integrate sustainable practices and to be flexible in the organization will be crucial for market leadership. Suppliers need to strategically align their product development and marketing efforts to capitalize on these trends and stay competitive in an increasingly complex market.

Leave a Comment