Market Trends

Introduction

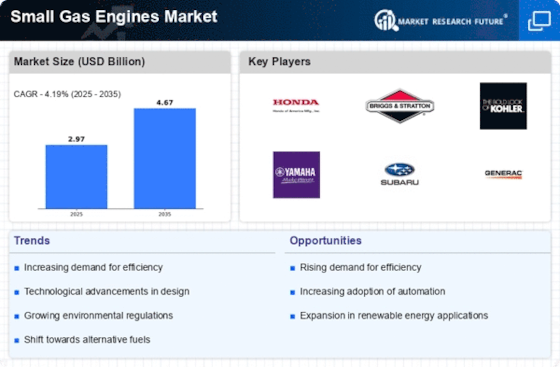

Small gas engine market is a major transformation in 2024, driven by a confluence of macroeconomic factors. The development of technology will lead to more efficient and environmentally friendly engines, which will be in line with the increasing regulatory pressure to reduce emissions and promote sustainable development. In addition, changes in the behavior of consumers, especially the increased demand for portable and versatile power solutions, will also change the market's demand dynamics. These trends are strategically important for the industry, not only influencing the development and innovation of products, but also determining the competitive positioning of products in a rapidly changing market.

Top Trends

-

Increased Demand for Eco-Friendly Solutions

With the growing concern for the environment, there has been a significant shift towards small, low-pollution, gasoline-driven engines. Governments are introducing ever-tighter regulations on exhaust emissions, forcing manufacturers to think outside the box. Honda, for example, has developed engines that meet the latest EPA regulations, reducing emissions by up to 50 per cent. This trend is expected to increase the investment in R&D of cleaner technology, which will affect the cost of production and thus the market position of the companies. -

Technological Advancements in Engine Efficiency

In the engines, the progress of technology is reducing fuel consumption and improving performance. Briggs & Stratton, for example, is able to integrate into its engines the most advanced fuel injection systems, which gives an improvement of up to 20 per cent. This trend, which meets not only the consumers’ demand for cheap solutions, but also the demand for sustainable products, may have the effect of reshaping the market. -

Rise of Electric Hybrid Models

It is the turn of the small gas engines to be enriched with the electric hybrid. The leaders of the industry are working on hybrid technology to combine the advantages of gas and electricity. For example, Kawasaki is developing hybrid engines that can reduce consumption by 30 per cent. This trend could have a strong influence on the future of the product range. -

Expansion of Applications in Diverse Industries

Gas motors are used in various fields, including agriculture, construction, and gardening. These motors are becoming widely recognized as versatile engines, and companies like Yamaha are expanding their product lines to accommodate them. The expansion of their product lines is expected to help them penetrate new markets and to create new sources of revenue. -

Focus on User-Friendly Features

Small gasoline engines are becoming more and more oriented towards the comfort of the user. These innovations are mainly the easy starting system and the light design. For example, Champion Power Equipment has introduced easier to use and broader models. It is expected that this trend will increase sales and customer loyalty. -

Increased Investment in Research and Development

A noticeable increase in R & D expenditure is being made by the leading companies in order to develop and improve small gas engines. The reports show an increase of 15 per cent in R & D expenditure. This trend is essential for the preservation of the competitive edge and for meeting the demands of the consumers. -

Growing Popularity of Portable Power Equipment

Consumers are becoming more and more demanding of small portable engines and the tools they power. Sales of lawn mowers and portable generators are increasing. This development will probably lead to the diversification of products by the manufacturers to satisfy the growing market for portable equipment. -

Regulatory Compliance and Standards

The compliance with the requirements of the new regulations is becoming a key focus for the industry. The stricter requirements for exhaust and noise emissions are causing the manufacturers to adapt their products accordingly. For example, the engines from Kohler have been redesigned to meet the new standards. This may result in higher operating costs, but it will also enhance the brand's credibility in the market. -

Emergence of Smart Engine Technologies

Small gas engines have begun to be integrated with intelligent technology. It can be connected to the Internet of Things, and it can be remotely monitored. It is expected that Fuji Heavy Industries will revolutionize the market by re-examining the relationship between the machine and the owner. -

Sustainability Initiatives by Industry Leaders

The most successful companies in the industry have been increasingly adopting a sustainable approach to their operations and products. The focus is on reducing the carbon footprint and on using sustainable materials. Kubota, for example, has set itself the goal of achieving the highest possible degree of compliance with international standards. This may have a positive effect on the brand’s image and on customer loyalty in the long run.

Conclusion: Navigating the Small Gas Engines Landscape

The competition in the Small Gas Engines Market is characterized by a significant fragmentation, with both established and new players competing for a share of the market. The trends in the region have a strong focus on the environment and compliance with regulations, which forces the suppliers to invent new products. The market is characterized by a strong focus on the technological development of products, with a view to capturing the growing demand for intelligent engines. The established companies have the advantage of a strong brand loyalty and a distribution network, while the new entrants can focus on advanced capabilities such as integration of artificial intelligence, automation and flexibility in the design to capture the growth of the market in the most advanced areas. The ability to meet the demands for sustainability and implement new technology will be the decisive factor for market leadership in the future. The suppliers must therefore focus on developing these capabilities to not only meet the needs of consumers, but also to differentiate themselves in an increasingly competitive market.

Leave a Comment