Market Analysis

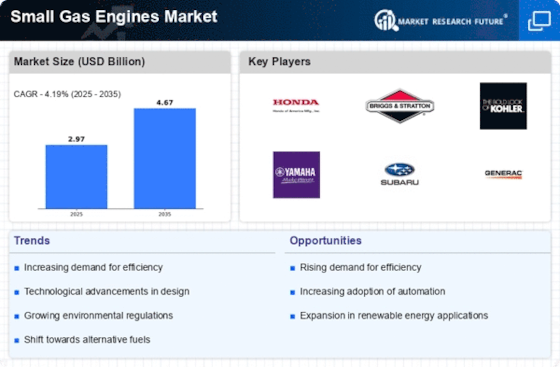

Small Gas Engines Market (Global, 2024)

Introduction

The Small Gasoline Engines Market is a global market for small engines, which are used in a wide range of applications, including lawn mowers, portable generators, and various outdoor power tools. Since consumers are increasingly demanding more efficient and environmentally friendly solutions, the manufacturers are increasingly focusing on technological advancements to increase engine performance and reduce emissions. There are several established and emerging companies in this market. The growing trend of self-help and outdoor recreation activities is expected to drive the demand for small engines.

PESTLE Analysis

- Political

- In 2024, the market for small gas engines will be influenced by various political factors, including government regulations aimed at reducing emissions. For example, the EPA in the United States has set a target of reducing greenhouse gas emissions from small engines by 30 percent by 2025. This will affect both the compliance costs of manufacturers and their product development strategies. In addition, the European Union has tightened its emissions standards with the introduction of the Euro 5 standard, which requires small engines to emit no more than 300 milligrams per kilowatt-hour of nitrogen dioxide. This will require manufacturers to develop new products and adapt their existing technology.

- Economic

- The market for small gas engines in 2024 will be influenced by the price of fuel and by the spending habits of consumers. In the United States, the average price of gasoline in the first quarter of 2024 was approximately $3.50 per gallon. This could have an effect on the demand for gasoline-powered tools. In addition, the unemployment rate in the United States was 4.2%, which indicates a relatively stable job market that supports consumer spending. This economic stability is crucial for the sale of small engines, especially in industries such as horticulture and construction, where the need for reliable equipment is high.

- Social

- In 2024, the trend towards an increased demand for the environment is influencing the choice of consumers in the market for small gas engines. According to a survey, 65% of consumers are willing to pay a premium for products marketed as “eco-friendly.” The manufacturers are responding to the demands of consumers by investing in cleaner technology and alternative fuels such as lp gas and electric engines. In addition, the aging population in many developed countries is increasing the demand for lightweight and easy-to-use gas-driven tools.

- Technological

- The market for small gas-engines is rapidly changing in 2024, with the rapid evolution of technology. Fuel injection and the use of electronic controls are reducing the size of the engine and increasing its efficiency. Variable valve timing has, for example, increased the fuel efficiency of small engines by up to 15 per cent. Moreover, the integration of Internet of Things technology in small engines allows for remote diagnosis and up to a 20 per cent reduction in the cost of maintenance. These technological developments are essential if the manufacturers are to remain competitive in a market where the importance of reliability and efficiency is growing.

- Legal

- The legal factors affecting the market for small gas engines in 2024 are compliance with various safety and environment regulations. The OSHA has issued regulations requiring manufacturers to meet certain safety standards, and this can cost up to $500,000 for testing and certification. The Clean Air Act also requires manufacturers to meet certain emission limits, which requires them to spend on R & D. Failure to comply with these regulations can result in fines of up to $100,000 per offense.

- Environmental

- In 2024, the environment will be the most important factor in the small gas engine market, as the concern about climate change and air pollution drives the regulatory framework. The global drive for sustainability has led to initiatives such as the Paris Agreement, which aims to limit global warming to below 2°C. The small gas engine industry has been asked to reduce emissions by half by 2030. Also, the question of the recyclability of the engines is becoming important, and it is estimated that 30% of the materials used in engines are now made from recovered materials, thus contributing to the circular economy.

Porter's Five Forces

- Threat of New Entrants

- The market for small gas engines is characterized by moderate barriers to entry, such as the need for a large investment in manufacturing and technical facilities. Brand loyalty and economies of scale are also a major deterrent to new entrants. However, the development of technology and the growing demand for small gas engines in various applications may lead to new competition.

- Bargaining Power of Suppliers

- The suppliers’ bargaining power in the small gas engine market is relatively low, due to the availability of a number of suppliers of raw materials and components. The suppliers can be easily changed if prices are raised or quality is not satisfactory, and this helps to keep suppliers’ power under control. In addition, the availability of substitute materials and components helps to reduce the suppliers’ power.

- Bargaining Power of Buyers

- The buyers of small gas engines have high bargaining power, because of the wide choice of products and the ease of comparing them. Customers can demand lower prices and higher quality products. This forces the companies to improve their products and services in order to retain their customers.

- Threat of Substitutes

- The threat of substitutes for small gas engines is moderate. The popularity of alternative energy sources, such as electric motors and batteries, is increasing. These alternatives will not replace small gas engines in all applications, but their efficiency and cost will increase and will pose a challenge to the traditional gas engine manufacturers.

- Competitive Rivalry

- Competition in the small gas engine market is high, with many manufacturers competing for market share. Price, quality, and technological superiority are the three factors that set one manufacturer apart from another. The presence of both established brands and new entrants makes competition even keener. This, in turn, has led to aggressive marketing and continuous product development to set one’s product apart from the others.

SWOT Analysis

Strengths

- Established technology with a wide range of applications in various industries.

- Strong demand in outdoor power equipment, such as lawn mowers and generators.

- Robust supply chain and manufacturing capabilities in key regions.

Weaknesses

- Environmental regulations limiting emissions may hinder market growth.

- Dependence on fossil fuels, which may face declining public acceptance.

- Limited innovation compared to electric alternatives.

Opportunities

- Growing demand for portable power solutions in remote areas.

- Potential for technological advancements in fuel efficiency and emissions reduction.

- Expansion into emerging markets with increasing infrastructure development.

Threats

- Intensifying competition from electric and hybrid engine technologies.

- Fluctuating fuel prices impacting operational costs.

- Potential regulatory changes aimed at reducing carbon footprints.

Summary

The market for small engines in 2024 will be characterized by established strengths such as a wide range of applications and strong demand for outdoor equipment. The market also has to deal with considerable weaknesses such as increasing regulation and competition from electric alternatives. Opportunities for growth are portable power solutions and technological developments. Threats are regulatory changes and volatile fuel prices. Strategic innovation and adaptation to the regulatory framework are key to continued growth.

Leave a Comment