Enhanced Security Features

The Smart Home Automation Market is propelled by the demand for enhanced security features in residential settings. Homeowners are increasingly concerned about safety and are turning to smart security systems that offer real-time monitoring, remote access, and automated alerts. The integration of advanced technologies such as facial recognition and motion detection in smart cameras and alarms is becoming commonplace. This heightened focus on security is reflected in market trends, with projections indicating that the smart security segment could grow by over 20% annually. As consumers prioritize safety, the Smart Home Automation Market is likely to expand in response to these evolving needs.

Integration of Voice Assistants

The Smart Home Automation Market is significantly influenced by the integration of voice assistants into smart home ecosystems. Voice-activated technologies, such as Amazon Alexa and Google Assistant, are transforming how consumers interact with their home devices. This integration allows for hands-free control of various functions, enhancing user convenience and accessibility. As voice recognition technology continues to improve, it is expected that more households will adopt smart home solutions that incorporate these features. Market analysis suggests that the voice assistant segment could see a growth rate of approximately 30% in the next few years, further driving the expansion of the Smart Home Automation Market.

Growing Awareness of Energy Efficiency

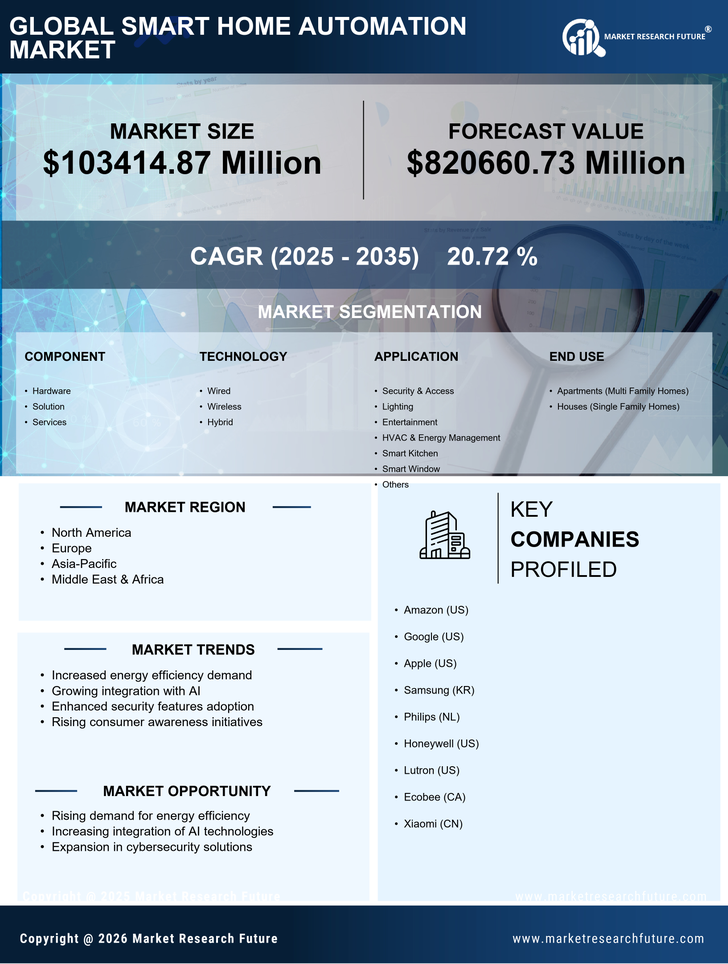

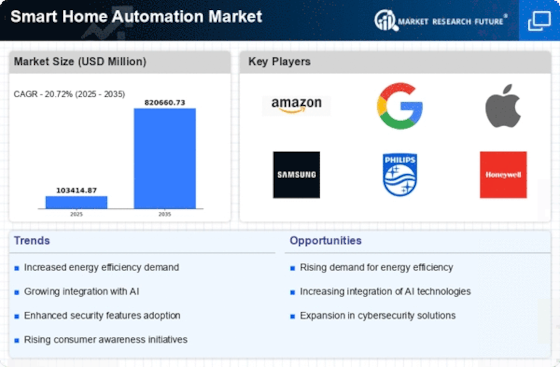

The Smart Home Automation Market is witnessing a growing awareness of energy efficiency among consumers. As environmental concerns escalate, individuals are increasingly inclined to adopt smart home solutions that reduce energy consumption and lower utility bills. Smart thermostats, lighting systems, and energy monitoring devices are becoming essential components of modern homes. This shift towards energy-efficient technologies is supported by government initiatives promoting sustainable practices. Market data indicates that energy-efficient smart home devices are projected to account for a significant share of the market, potentially reaching 40% by 2026. This trend underscores the importance of energy efficiency in driving the Smart Home Automation Market.

Rising Consumer Demand for Convenience

The Smart Home Automation Market is experiencing a notable surge in consumer demand for convenience and ease of use. As lifestyles become increasingly hectic, individuals seek solutions that simplify daily tasks. This trend is reflected in the growing adoption of smart devices that allow users to control home functions remotely, enhancing comfort and efficiency. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This indicates a robust appetite for smart home technologies that streamline household management, thereby driving innovation and investment in the Smart Home Automation Market.

Advancements in Internet of Things (IoT) Technology

The Smart Home Automation Market is significantly influenced by advancements in Internet of Things (IoT) technology. The proliferation of connected devices enables seamless communication between various home systems, enhancing user experience and functionality. As IoT technology evolves, it facilitates the integration of smart appliances, security systems, and energy management tools, creating a cohesive ecosystem. This interconnectedness not only improves convenience but also promotes energy efficiency, which is increasingly prioritized by consumers. The market is expected to witness substantial growth as IoT adoption continues to rise, with estimates suggesting a potential increase in market size by over 30% in the coming years.