Research Methodology on Smart Home Office Market

Objective:

The objective of this research methodology is to identify and analyze key components related to the smart home office market and its growth potential in the global arena. This will include an in-depth analysis of historical data, market dynamics, competition analysis, market segmentation and targeting, and the current and future state of the market.

Scope of the Study:

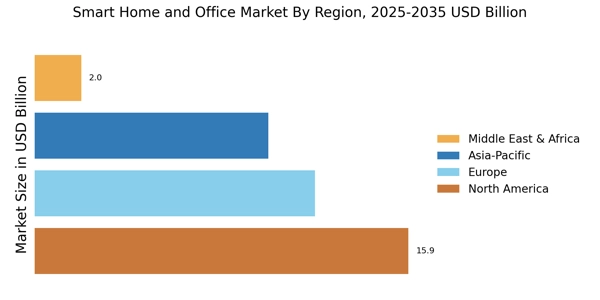

The scope of the study includes information regarding market trends, drivers and challenges, opportunities, key vendors in the market, and the projected growth rate of the market in the future. The research methodology will be completed by examining the various regional markets, such as North America, Europe, Asia-Pacific, and the Rest of the World.

Research Methodology:

This study will utilize the following research methodology in order to gain a better understanding of the global smart home office market:

Primary Research: The primary research component of the research methodology will involve in-depth interviews of industry experts, C-level executives, product managers, and related government officials. Open-ended and close-ended questions will be used to gain an understanding of the current state of the market, emerging market trends, and areas of growth potential for the market.

Secondary Research: The secondary research component of the research methodology will include market reports, press releases, company annual reports, and other materials related to the global smart home office market. This will allow the analyst to gain a comprehensive understanding of the overall market landscape and to identify key vendors, challenges, and opportunities.

Market Segmentation and Targeting: The segmentation and targeting analysis will provide insights into the current landscape of the market and identify specific regions, countries, and segments that have the potential to experience significant growth in the near future. This analysis will also provide a better understanding of the market’s competitive dynamics and help to recognize areas where businesses can gain a competitive advantage.

Competitive Analysis: The competitive analysis will involve the creation of a competitive positioning matrix to identify the current market share, recent announcements, strategies, and entry barriers of each major competitor in the market. This information will then be used to identify key vendors and areas of opportunity.

SWOT Analysis: A SWOT analysis will be conducted in order to gain a holistic understanding of the global smart home office market and to identify key strengths, weaknesses, opportunities, and threats that could impact the market’s future growth potential.

Market Forecast: A market forecast will then be generated for the global smart home office market for 2023 to 2030. This will include an analysis of historical data, market dynamics, competitive analysis, and market segmentation and targeting in order to provide insights into the market’s expected growth rate.

Market Estimation: Finally, the research methodology will also include an estimation of the global market size for 2023-2030 in order to gain an understanding of the current and future revenue potential of the market.

Overall, the research methodology outlined in this document will provide a comprehensive overview of the global smart home office market and its potential for future growth. This will enable market participants and investors to gain a better understanding of the industry and to identify areas where they can gain a competitive edge.