Market Growth Projections

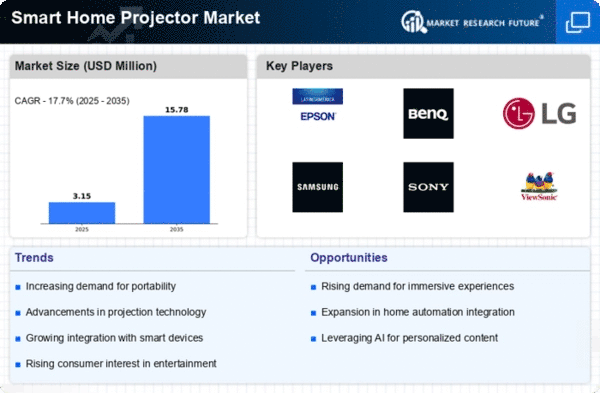

The Global Smart Home Projector Market Industry is poised for substantial growth in the coming years. Projections indicate that the market will reach 2.73 USD Billion in 2024, with an anticipated expansion to 16.4 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 17.7% from 2025 to 2035. Such figures reflect the increasing consumer interest in smart home technologies and the evolving landscape of home entertainment. The market's expansion is likely to be driven by technological innovations, changing consumer preferences, and the integration of projectors into smart home ecosystems. These projections underscore the market's potential and the opportunities it presents for stakeholders.

Emerging Markets and Urbanization

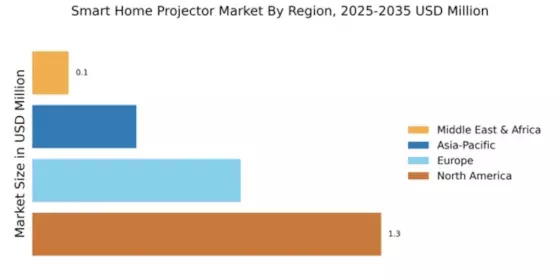

Emerging markets and urbanization are key drivers of the Global Smart Home Projector Market Industry. As urban populations grow, the demand for space-efficient entertainment solutions increases. Projectors offer a practical alternative to bulky televisions, making them appealing to urban dwellers with limited space. Countries in Asia-Pacific and Latin America are experiencing rapid urbanization, leading to a rise in disposable income and consumer spending on home entertainment. This demographic shift presents significant opportunities for projector manufacturers to tap into new markets. As urbanization continues, the market is likely to see accelerated growth, with projections indicating a potential market size of 16.4 USD Billion by 2035.

Growing Interest in Outdoor Entertainment

The Global Smart Home Projector Market Industry is witnessing a growing interest in outdoor entertainment solutions. Consumers increasingly seek ways to enhance their outdoor experiences, leading to a rise in demand for portable projectors suitable for outdoor use. This trend is particularly relevant during warmer months when families and friends gather for outdoor movie nights or events. The versatility of projectors allows for large-screen viewing in various settings, from backyards to parks. As outdoor entertainment becomes a popular pastime, the market is expected to expand, catering to consumers' desires for unique and engaging experiences. This shift may contribute to the projected growth of the market.

Increasing Adoption of Smart Home Devices

The increasing adoption of smart home devices significantly influences the Global Smart Home Projector Market Industry. As households integrate more smart technologies, the demand for compatible projectors rises. Projectors that can connect with smart assistants and other devices enhance user convenience and control. This trend is particularly pronounced in regions with high smart home penetration, such as North America and Europe. The synergy between smart home systems and projectors creates a seamless entertainment experience, appealing to tech-savvy consumers. As the market evolves, the integration of projectors into smart home ecosystems is likely to become a standard feature, further driving market growth.

Rising Demand for Home Entertainment Solutions

The Global Smart Home Projector Market Industry experiences a notable surge in demand for home entertainment solutions. As consumers increasingly seek immersive viewing experiences, projectors are becoming a preferred choice over traditional televisions. The market is projected to reach 2.73 USD Billion in 2024, driven by advancements in projection technology and enhanced image quality. This trend is particularly evident in urban areas where space constraints make projectors an appealing alternative. The growing popularity of streaming services further fuels this demand, as users desire larger screens for an enhanced viewing experience. Consequently, the market is likely to witness substantial growth in the coming years.

Technological Advancements in Projection Technology

Technological advancements play a pivotal role in shaping the Global Smart Home Projector Market Industry. Innovations such as 4K resolution, laser projection, and smart connectivity features are enhancing the functionality and appeal of projectors. These advancements not only improve image quality but also facilitate seamless integration with smart home ecosystems. As consumers become more tech-savvy, the demand for high-performance projectors is expected to rise. The introduction of compact and portable models further caters to the needs of modern consumers, allowing for versatile usage in various settings. This trend indicates a promising future for the market, potentially leading to a CAGR of 17.7% from 2025 to 2035.