Focus on Health and Wellness

The smart oven Market is also influenced by a growing consumer focus on health and wellness. As individuals become more health-conscious, there is an increasing demand for cooking appliances that facilitate healthier meal preparation. Smart ovens often come with features that promote healthier cooking methods, such as steaming, grilling, and air frying, which can reduce the need for excessive oil and fats. Market data suggests that the health and wellness food sector is expected to grow significantly, with consumers seeking appliances that align with their dietary preferences. This trend is further supported by the rise of meal planning and portion control features in smart ovens, which assist users in preparing balanced meals. Consequently, the emphasis on health and wellness is likely to drive the growth of the Smart Oven Market, as consumers seek appliances that support their lifestyle choices.

Integration of Smart Technology

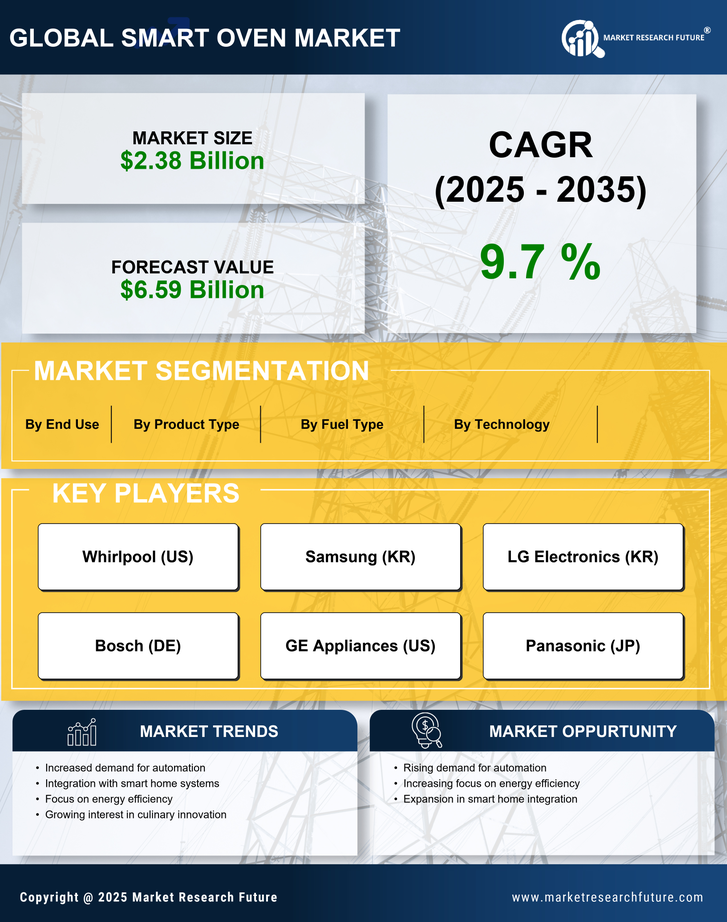

The Smart Oven Market is experiencing a notable surge due to the integration of advanced smart technologies. These ovens are equipped with features such as Wi-Fi connectivity, voice control, and mobile app integration, allowing users to monitor and control cooking processes remotely. According to recent data, the adoption of smart appliances is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This trend indicates a shift in consumer preferences towards convenience and efficiency, driving demand for smart ovens. Furthermore, the ability to receive real-time updates and notifications enhances user experience, making smart ovens increasingly appealing to tech-savvy consumers. As a result, manufacturers are investing heavily in research and development to innovate and enhance the functionalities of smart ovens, thereby propelling the Smart Oven Market forward.

Sustainability and Energy Efficiency

Sustainability and energy efficiency are becoming increasingly critical drivers in the Smart Oven Market. Consumers are more aware of their environmental impact and are seeking appliances that minimize energy consumption. Smart ovens often feature energy-saving modes and advanced insulation technologies that reduce energy usage during cooking. Data indicates that energy-efficient appliances can lead to significant cost savings on utility bills, which is appealing to budget-conscious consumers. Additionally, manufacturers are focusing on sustainable materials and production processes, aligning with the growing demand for eco-friendly products. This shift towards sustainability not only meets consumer expectations but also complies with regulatory standards aimed at reducing carbon footprints. As a result, the emphasis on sustainability and energy efficiency is likely to propel the Smart Oven Market, as consumers increasingly prioritize environmentally responsible choices.

Rising Urbanization and Lifestyle Changes

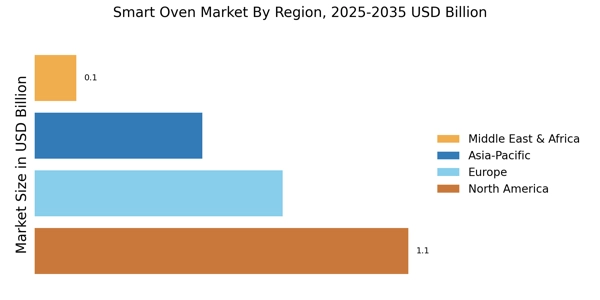

The Smart Oven Market is significantly impacted by rising urbanization and changing lifestyles. As urban populations grow, there is a corresponding increase in demand for compact and multifunctional kitchen appliances that cater to the needs of smaller living spaces. Smart ovens, with their ability to perform multiple cooking functions, are particularly appealing to urban dwellers who may have limited kitchen space. Furthermore, the fast-paced lifestyle of urban consumers often necessitates quick and efficient cooking solutions. Market Research Future indicates that urban areas are witnessing a shift towards convenience-oriented cooking, which aligns with the capabilities of smart ovens. This trend suggests that as urbanization continues, the Smart Oven Market will likely expand, driven by the need for innovative cooking solutions that fit modern lifestyles.

Increased Consumer Awareness and Education

Increased consumer awareness and education regarding smart appliances are pivotal drivers in the Smart Oven Market. As consumers become more informed about the benefits and functionalities of smart ovens, their willingness to invest in such technology grows. Educational initiatives, including online tutorials and cooking classes, are helping to demystify the use of smart ovens, showcasing their versatility and ease of use. Market data indicates that consumer interest in smart home technology is on the rise, with many individuals actively seeking information on how to integrate these appliances into their homes. This heightened awareness is likely to translate into increased sales and adoption of smart ovens, as consumers recognize the potential for enhanced cooking experiences. Consequently, the Smart Oven Market is poised for growth as education and awareness continue to play a crucial role in shaping consumer preferences.