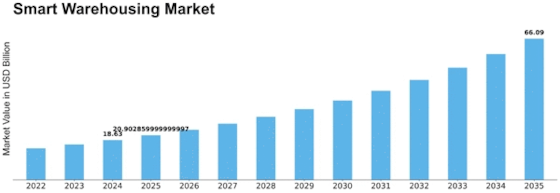

Smart Warehousing Size

Smart Warehousing Market Growth Projections and Opportunities

The Smart Warehousing market is influenced by several key factors that shape its growth trajectory. One significant factor driving the market is the increasing adoption of automation and technology in warehouse operations. As businesses strive to enhance efficiency and reduce costs, they are turning to smart warehousing solutions to streamline processes such as inventory management, order fulfillment, and logistics. Automation technologies like robotics, AI, IoT sensors, and cloud computing are being integrated into warehouses to optimize operations and improve overall productivity.

Another important market factor is the rising demand for real-time visibility and transparency in supply chain management. With the growth of e-commerce and omnichannel retailing, there is a greater need for accurate, up-to-date information on inventory levels, order status, and delivery schedules. Smart warehousing solutions leverage technologies such as RFID, barcode scanning, and advanced analytics to provide real-time insights into inventory movement and facilitate better decision-making across the supply chain.

Moreover, the increasing focus on sustainability and environmental responsibility is driving the adoption of green technologies in warehousing. Companies are seeking ways to reduce their carbon footprint and minimize waste in their operations. Smart warehousing solutions offer opportunities to optimize energy usage, reduce emissions, and implement eco-friendly practices such as paperless processes and sustainable packaging materials.

Furthermore, the growing complexity of global supply chains and the need for agility in response to changing market dynamics are fueling demand for flexible and scalable warehouse solutions. Smart warehousing platforms offer scalability and customization options, allowing businesses to adapt to evolving requirements and optimize their operations to meet customer demands effectively.

Additionally, government regulations and industry standards play a crucial role in shaping the smart warehousing market landscape. Compliance requirements related to data privacy, safety standards, and labor practices impact the design and implementation of smart warehousing solutions. Companies must ensure that their systems meet regulatory requirements and adhere to industry best practices to mitigate risks and maintain operational compliance.

Moreover, the competitive landscape and market dynamics also influence the growth of the smart warehousing market. With the rise of e-commerce giants and third-party logistics providers, there is intense competition among companies to differentiate themselves through superior service offerings and operational efficiency. Smart warehousing solutions enable companies to gain a competitive edge by optimizing their warehouse operations, reducing costs, and improving customer satisfaction.

Furthermore, economic factors such as GDP growth, consumer spending patterns, and market volatility impact investment decisions and expansion plans in the warehousing sector. As economies recover from global downturns or experience periods of growth, businesses may adjust their warehousing strategies to capitalize on emerging opportunities or mitigate risks associated with market fluctuations.

Leave a Comment