Diverse Applications Across Industries

The versatility of sodium-ion batteries is a significant driver for the Sodium-Ion Battery Market. These batteries are not limited to a single application; they can be utilized in various sectors, including electric vehicles, grid energy storage, and consumer electronics. This broad applicability enhances market potential, as different industries seek efficient and cost-effective energy storage solutions. Market trends indicate that as industries increasingly adopt electric mobility and renewable energy systems, the demand for sodium-ion batteries will likely rise. This diverse application landscape suggests that the Sodium-Ion Battery Market is poised for robust growth, catering to a wide range of energy storage needs.

Cost-Effectiveness and Material Abundance

One of the primary drivers for the Sodium-Ion Battery Market is the cost-effectiveness associated with sodium-ion technology. Sodium, being more abundant and less expensive than lithium, allows for the production of batteries at a lower cost. This economic advantage is particularly appealing to manufacturers and consumers alike, as it could lead to reduced prices for energy storage systems. Furthermore, the availability of sodium resources mitigates supply chain risks often associated with lithium mining. Market analysis shows that the cost of sodium-ion batteries is projected to decrease further as production scales up, making them an attractive option for various applications, including grid storage and electric vehicles. This trend indicates a promising future for the Sodium-Ion Battery Market.

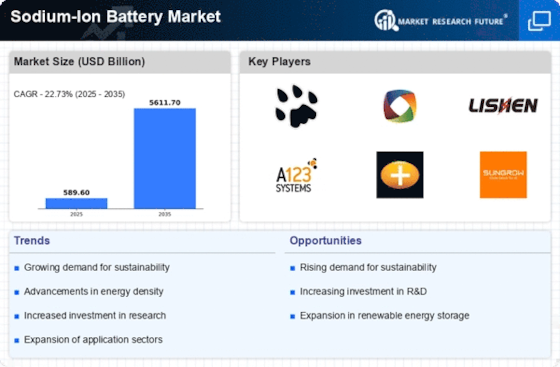

Increasing Demand for Renewable Energy Storage

The Sodium-Ion Battery Market is experiencing a surge in demand driven by the increasing need for efficient energy storage solutions. As renewable energy sources such as solar and wind become more prevalent, the requirement for reliable storage systems to manage intermittent energy supply is paramount. Sodium-ion batteries, with their potential for lower costs and abundant raw materials, present a viable alternative to traditional lithium-ion batteries. Market data indicates that the energy storage sector is projected to grow significantly, with sodium-ion batteries expected to capture a notable share due to their favorable characteristics. This trend suggests that the Sodium-Ion Battery Market is well-positioned to benefit from the global transition towards sustainable energy solutions.

Regulatory Support for Sustainable Technologies

The Sodium-Ion Battery Market is benefiting from increasing regulatory support aimed at promoting sustainable technologies. Governments worldwide are implementing policies and incentives to encourage the adoption of cleaner energy solutions, including energy storage systems. This regulatory environment fosters investment in sodium-ion battery technology, as it aligns with global sustainability goals. For instance, initiatives aimed at reducing carbon emissions and enhancing energy efficiency are likely to create a favorable market landscape for sodium-ion batteries. As these regulations become more stringent, the Sodium-Ion Battery Market may experience accelerated growth, driven by the need for compliant and sustainable energy storage solutions.

Technological Innovations and Research Advancements

Technological innovations play a crucial role in the growth of the Sodium-Ion Battery Market. Ongoing research and development efforts are focused on enhancing the performance and efficiency of sodium-ion batteries. Recent advancements in electrode materials and battery design have shown potential for improved energy density and cycle life, making these batteries more competitive with established technologies. As researchers continue to explore new materials and manufacturing techniques, the Sodium-Ion Battery Market is likely to witness significant improvements in battery performance. This innovation-driven landscape suggests that sodium-ion technology could become a mainstream solution in energy storage applications, further propelling market growth.