Rising Demand for Renewable Energy

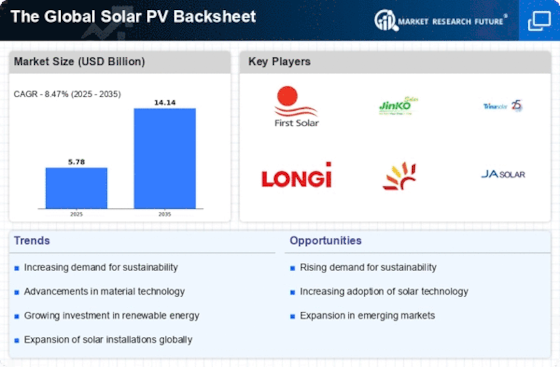

The increasing The Global Solar PV Backsheet Industry. As nations strive to meet their energy needs sustainably, the demand for solar energy systems has surged. According to recent data, the solar energy sector is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth directly correlates with the need for high-quality backsheets, which protect solar panels from environmental factors. The Solar PV Backsheet Market is thus positioned to benefit from this trend, as manufacturers seek to provide durable and efficient materials that enhance the longevity and performance of solar panels.

Government Incentives and Subsidies

Government policies and incentives play a pivotal role in shaping the Solar PV Backsheet Market. Many countries are implementing financial incentives to promote the adoption of solar energy, which in turn boosts the demand for solar panels and their components, including backsheets. For example, tax credits, grants, and subsidies for solar installations can significantly lower the upfront costs for consumers and businesses. This financial support encourages more investments in solar technology, thereby increasing the market for backsheets. As governments continue to prioritize renewable energy, the Solar PV Backsheet Market is expected to experience sustained growth driven by these supportive policies.

Expansion of Solar Energy Infrastructure

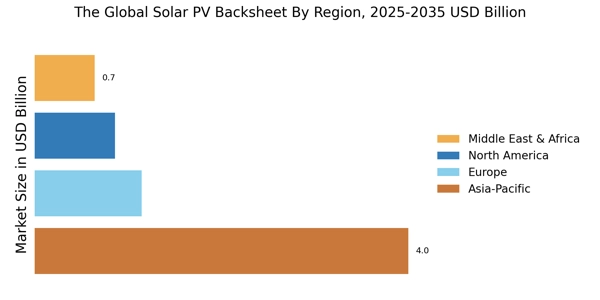

The expansion of solar energy infrastructure is a significant factor influencing the Solar PV Backsheet Market. As countries invest in large-scale solar farms and decentralized solar installations, the need for reliable and efficient backsheets becomes paramount. The global solar capacity is expected to reach over 2,000 GW by 2025, indicating a robust growth trajectory. This expansion necessitates high-quality materials that can withstand various environmental conditions while ensuring optimal performance. The Solar PV Backsheet Market is thus poised for growth, as manufacturers align their production capabilities with the increasing demand for solar energy infrastructure.

Growing Awareness of Environmental Impact

The rising awareness of environmental issues is a crucial driver for the Solar PV Backsheet Market. As consumers and businesses become more conscious of their carbon footprints, there is a marked shift towards sustainable energy solutions. This awareness is fostering a greater acceptance of solar energy as a viable alternative to fossil fuels. Consequently, the demand for solar panels, and by extension, the materials that comprise them, including backsheets, is on the rise. The Solar PV Backsheet Market is likely to see increased investments as stakeholders recognize the importance of sustainable practices in energy production.

Technological Innovations in Material Science

Advancements in material science are significantly influencing the Solar PV Backsheet Market. Innovations such as the development of new polymer materials and coatings enhance the durability and efficiency of solar panels. For instance, backsheets that incorporate advanced UV-resistant materials can extend the lifespan of solar modules, which is crucial for maintaining energy output over time. The market is witnessing a shift towards backsheets that not only provide protection but also improve energy efficiency. This trend is likely to drive competition among manufacturers, pushing them to invest in research and development to create superior products that meet the evolving needs of the solar energy sector.