Government Incentives and Policies

Supportive government policies and incentives play a crucial role in shaping the Thin Film Solar PV Backsheet Market. Many countries have implemented favorable regulations and financial incentives to promote the adoption of solar energy. For example, tax credits, rebates, and feed-in tariffs are designed to encourage investments in solar technologies. In 2025, it is anticipated that these incentives will continue to stimulate market growth, as they lower the initial costs associated with solar installations. Consequently, the demand for thin film solar PV backsheets is likely to increase, as manufacturers seek to comply with regulatory standards while providing cost-effective solutions. This supportive regulatory environment is essential for the sustained growth of the Thin Film Solar PV Backsheet Market.

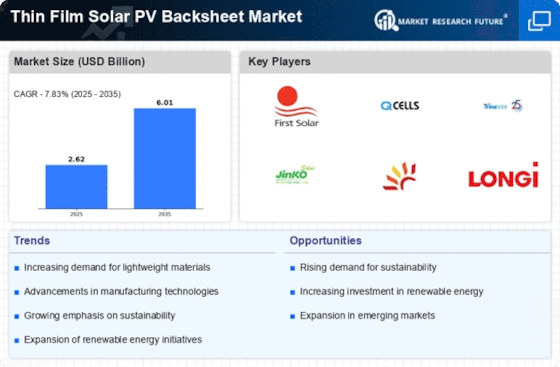

Rising Demand for Renewable Energy

The increasing The Thin Film Solar PV Backsheet Industry. As nations strive to meet ambitious carbon reduction targets, the demand for solar energy solutions has surged. In 2025, the solar energy sector is projected to grow at a compound annual growth rate of approximately 20%, indicating a robust market for solar technologies. This growth is likely to enhance the demand for thin film solar PV backsheets, which are essential for the durability and efficiency of solar panels. The shift towards sustainable energy solutions is not merely a trend but a fundamental change in energy consumption patterns, thereby propelling the Thin Film Solar PV Backsheet Market forward.

Expansion of Solar Energy Applications

The diversification of solar energy applications is emerging as a vital driver for the Thin Film Solar PV Backsheet Market. Beyond traditional residential and commercial installations, solar technology is increasingly being integrated into various sectors, including automotive, agriculture, and building-integrated photovoltaics (BIPV). This expansion is likely to create new opportunities for thin film solar PV backsheets, which are particularly suited for flexible and lightweight applications. As of 2025, the integration of solar technology into innovative applications is projected to grow, thereby increasing the demand for specialized backsheets that can meet diverse performance requirements. This trend indicates a promising future for the Thin Film Solar PV Backsheet Market, as it adapts to the evolving landscape of solar energy utilization.

Growing Awareness of Environmental Issues

The rising awareness of environmental issues among consumers and businesses is a significant driver for the Thin Film Solar PV Backsheet Market. As climate change becomes an increasingly pressing concern, there is a growing preference for sustainable energy solutions. Surveys indicate that a substantial percentage of consumers are willing to pay a premium for products that are environmentally friendly. This shift in consumer behavior is likely to boost the demand for solar energy systems, including those utilizing thin film technology. In 2025, the market for eco-friendly solar solutions is expected to expand, further enhancing the need for high-performance backsheets that contribute to the overall sustainability of solar panels. The heightened focus on environmental responsibility is thus a key factor influencing the Thin Film Solar PV Backsheet Market.

Technological Innovations in Solar Technology

Technological advancements in solar panel manufacturing are significantly influencing the Thin Film Solar PV Backsheet Market. Innovations such as improved materials and production techniques have led to enhanced efficiency and lower costs for thin film solar panels. For instance, the introduction of new polymer materials has improved the thermal stability and UV resistance of backsheets, which are crucial for the longevity of solar panels. As of 2025, the efficiency of thin film solar cells has reached levels comparable to traditional silicon-based cells, making them a more attractive option for consumers. This technological evolution is expected to drive the demand for high-quality backsheets, thereby fostering growth in the Thin Film Solar PV Backsheet Market.