Expansion of Consumer Electronics

The consumer electronics sector continues to expand, contributing to the growth of the Solder Balls Market. With the proliferation of smart devices, including smartphones, tablets, and wearables, the demand for efficient soldering solutions is on the rise. In 2025, the consumer electronics market is projected to reach USD 1 trillion, with solder balls playing a crucial role in ensuring the reliability and performance of these devices. As manufacturers strive to meet consumer expectations for quality and durability, the need for high-quality solder balls becomes increasingly apparent. This trend suggests that the solder balls market will continue to thrive as consumer electronics evolve and diversify.

Growing Automotive Electronics Sector

The automotive sector is witnessing a significant transformation, with an increasing reliance on electronic components. The Solder Balls Market is poised to benefit from this trend, as vehicles become more technologically advanced. The integration of features such as advanced driver-assistance systems (ADAS) and electric vehicle (EV) technologies necessitates the use of high-performance solder balls. In 2025, the automotive electronics market is expected to surpass USD 300 billion, creating substantial opportunities for solder ball manufacturers. This growth is likely to be fueled by the rising demand for connectivity and automation in vehicles, which in turn drives the need for reliable soldering solutions in automotive applications.

Technological Advancements in Electronics

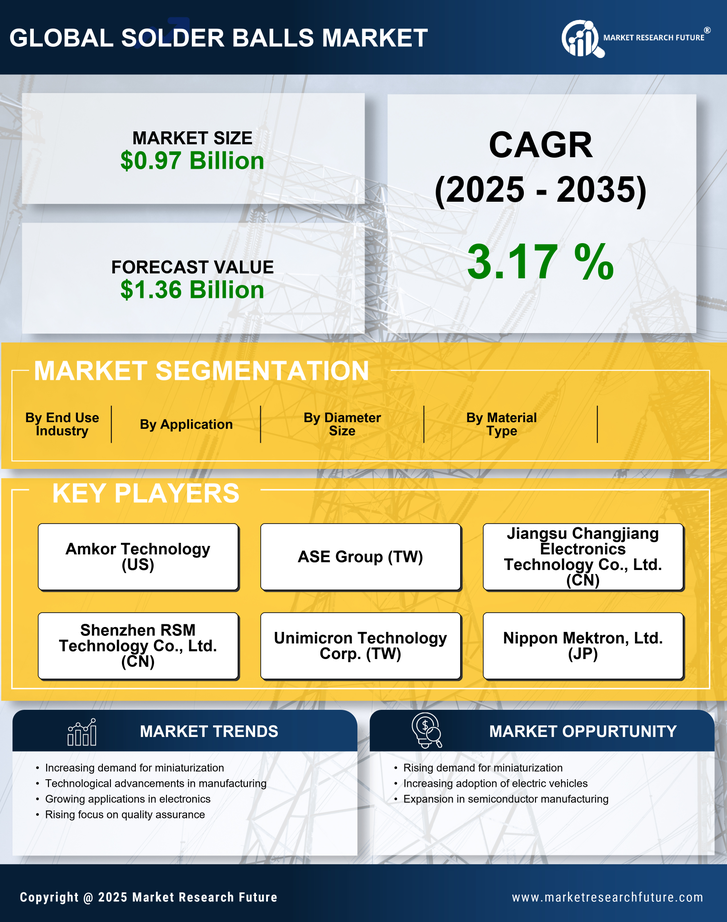

The Solder Balls Market is experiencing a notable surge due to rapid technological advancements in electronics. Innovations in semiconductor manufacturing processes and miniaturization of electronic components necessitate the use of high-quality solder balls. As devices become smaller and more complex, the demand for reliable soldering solutions increases. In 2025, the market for solder balls is projected to reach a valuation of approximately USD 1.5 billion, driven by the need for enhanced performance and reliability in electronic assemblies. Furthermore, the integration of advanced soldering techniques, such as reflow and wave soldering, is likely to bolster the market, as manufacturers seek to improve production efficiency and reduce defects in electronic products.

Regulatory Push for Environmental Compliance

The Solder Balls Market is also influenced by regulatory frameworks aimed at promoting environmental sustainability. Governments worldwide are implementing stringent regulations regarding the use of hazardous materials in electronics manufacturing. This regulatory push is driving the transition towards lead-free solder balls, which are more environmentally friendly. As manufacturers adapt to these regulations, the demand for compliant soldering solutions is likely to increase. In 2025, the market for lead-free solder balls is expected to account for a significant share of the overall solder balls market, reflecting the industry's commitment to sustainability and compliance with environmental standards.

Rising Investment in Research and Development

Investment in research and development (R&D) is a critical driver for the Solder Balls Market. Companies are increasingly allocating resources to innovate and develop advanced soldering materials and techniques. This focus on R&D is essential for addressing the evolving needs of the electronics industry, particularly in terms of performance and reliability. In 2025, it is anticipated that R&D expenditures in the solder balls sector will increase by approximately 15%, as manufacturers seek to enhance product offerings and maintain competitive advantages. This trend indicates a proactive approach to meeting market demands and suggests that the solder balls market will continue to evolve in response to technological advancements.