Growth in Automotive Electronics

The Solder Materials Market is significantly impacted by the growth in automotive electronics. With the automotive sector increasingly integrating advanced electronic systems, the demand for reliable solder materials is on the rise. In 2025, the automotive electronics market is projected to grow at a rate of around 7%, driven by the proliferation of electric vehicles and autonomous driving technologies. These advancements necessitate high-performance solder materials that can withstand the rigors of automotive applications. Manufacturers are focusing on developing solder materials that offer superior thermal and electrical conductivity, ensuring the reliability of critical automotive components. As the automotive industry continues to evolve, the need for innovative soldering solutions becomes paramount, positioning the Solder Materials Market as a key player in supporting this transformation.

Expansion of Renewable Energy Sector

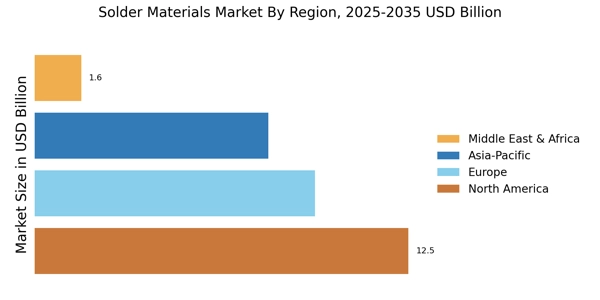

The Solder Materials Market is significantly influenced by the expansion of the renewable energy sector. As the world shifts towards sustainable energy solutions, the demand for solar panels and wind turbines is on the rise. In 2025, the renewable energy market is expected to grow by over 10% annually, creating a substantial need for solder materials used in the assembly of photovoltaic cells and other renewable energy components. Soldering plays a critical role in ensuring the durability and efficiency of these energy systems. Manufacturers are increasingly focusing on developing specialized solder materials that can withstand harsh environmental conditions, thereby enhancing the longevity of renewable energy installations. This trend not only supports the growth of the Solder Materials Market but also aligns with global sustainability goals, making it a crucial driver in the current market landscape.

Increasing Electronics Manufacturing

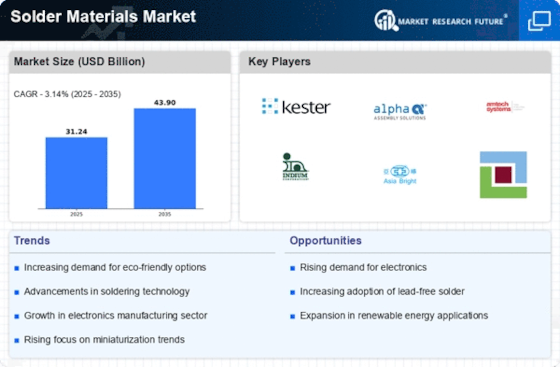

The Solder Materials Market is experiencing a notable surge due to the increasing demand for electronics manufacturing. As consumer electronics continue to evolve, manufacturers are ramping up production to meet consumer expectations. In 2025, the electronics sector is projected to grow at a compound annual growth rate of approximately 5.5%, which directly influences the demand for solder materials. This growth is driven by the proliferation of smart devices, wearables, and IoT applications, all of which require reliable soldering solutions. Consequently, manufacturers are investing in high-quality solder materials to ensure product reliability and performance. The need for efficient soldering processes in electronics assembly further propels the market, as companies seek to enhance production efficiency and reduce costs. Thus, the increasing electronics manufacturing landscape is a pivotal driver for the Solder Materials Market.

Regulatory Compliance and Quality Standards

The Solder Materials Market is increasingly shaped by regulatory compliance and quality standards. As industries face stricter regulations regarding the use of hazardous materials, the demand for lead-free solder solutions is rising. In 2025, it is estimated that over 80% of solder materials used in electronics will be lead-free, reflecting a significant shift towards safer alternatives. Compliance with international standards such as RoHS and REACH is driving manufacturers to innovate and develop solder materials that meet these stringent requirements. This trend not only enhances product safety but also opens new market opportunities for manufacturers who can provide compliant solder solutions. As regulatory frameworks continue to evolve, the Solder Materials Market is likely to experience sustained growth, driven by the need for high-quality, compliant solder materials.

Technological Advancements in Soldering Techniques

The Solder Materials Market is being propelled by technological advancements in soldering techniques. Innovations such as selective soldering, laser soldering, and automated soldering processes are transforming traditional methods. These advancements enhance precision and efficiency, reducing the risk of defects in solder joints. In 2025, the adoption of automated soldering solutions is anticipated to increase by approximately 15%, as manufacturers seek to optimize production lines. This shift not only improves the quality of solder joints but also minimizes waste and lowers production costs. Furthermore, the integration of smart technologies in soldering equipment allows for real-time monitoring and adjustments, ensuring optimal performance. As manufacturers embrace these cutting-edge soldering techniques, the demand for advanced solder materials that can meet the requirements of these technologies is likely to rise, thereby driving the Solder Materials Market forward.