Research Methodology on Solid State Drives Market

Abstract

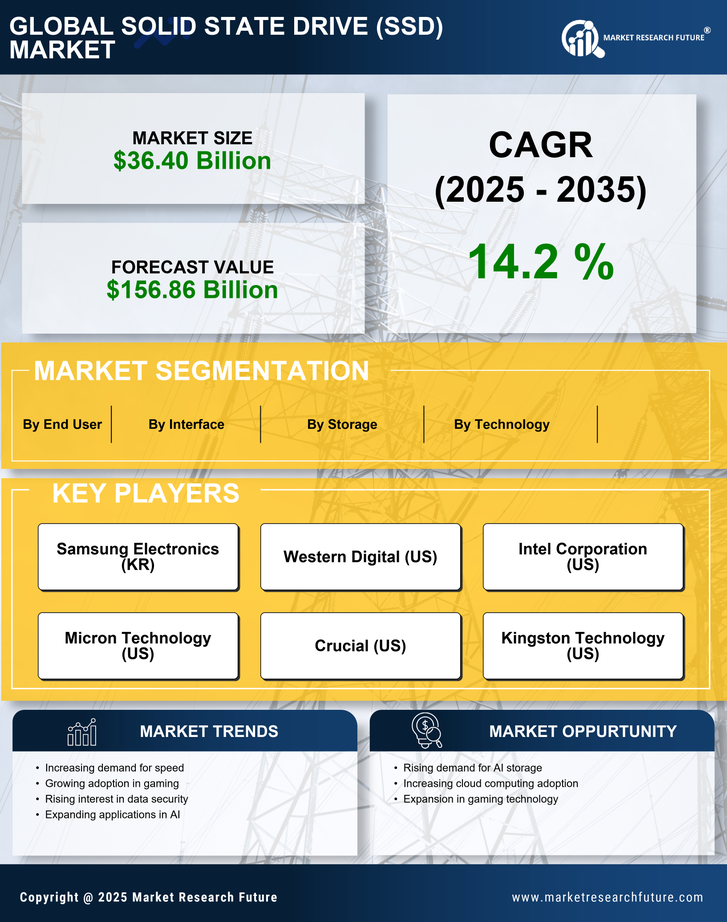

Solid-State Drives (SSD) are popular computer storage device that uses non-volatile flash memory to store data. It has seen a steady rise in popularity over the last couple of years due to its cost-effectiveness, speed, and energy efficiency. This study examines the current state of the market for SSDs, including market size, key segments and their growth, opportunities for market expansion, and the competitive landscape.

Introduction

The demand for Solid-State Drives (SSDs) is rising steadily over the past few years. They offer advantages over traditional spinning hard disk drives, such as increased speed and reduced power consumption. Additionally, they are becoming more cost-effective as technology continues to advance. This study aims to understand the current state of the Solid-State Drives (SSDs) market and what trends can be expected in the industry during the forecast period of 2023-2030.

Research Methodology

This research report is based on qualitative and quantitative analysis. Qualitative data and information is collected throughout the research study, to understand the current state of the market, its key segments, expansion opportunities, and other aspects. Primary research is conducted by speaking with industry experts, partners and stakeholders, analyzing trends in market-related databases, and collecting information from industry associations.

Secondary sources such as industry magazines, books, and reliable online sources like Bloomberg, Bloomberg Businessweek, official company websites and other research agencies were also consulted to obtain the required data and information. Also, data from the previous forecast years (2017-2022) and the present years (2023-2030) were compared and analyzed to conduct market assessment and estimation.

Market sizing is established with the help of market segmentation, where the market is divided into different smaller, discrete segments. This is then further examined and estimated to arrive at a market value, which is then validated by matching it with reliable sources. The market value is calculated using the top-down approach, where the total market value is divided into the underlying factors such as application and region. The bottom-up approach is also used to estimate the market size where the individual segment value was determined first, and then these values were consolidated to arrive at an overall market value. The market duration will cover the years 2023 through 2030.

Market Segmentation

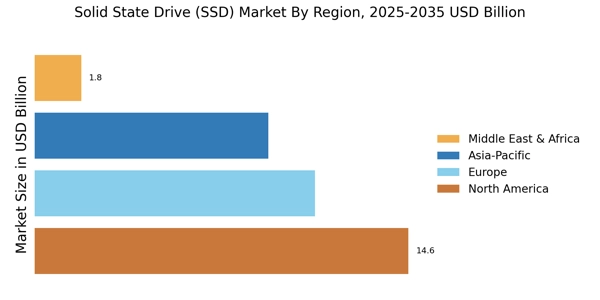

The global Solid-State Drives (SSD) market is segmented by application and region. Based on application, the market was further segmented into enterprise drives, consumer drives, and other applications. By region, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (ROW).

Data Collection and Analysis

Primary and secondary research is used to collect data and information for this report. Primary data is collected through interviews with market experts, partners and stakeholders to gain insights into the current state of the market, opportunities for expansion and future trends. Primary data is then analyzed to gain meaningful insights. Furthermore, secondary data is collected from reliable sources such as industry magazines, books, and websites of leading market research firms. A systematic approach was used to analyze the collected data.

Realistic Market Estimation

After collecting, collating and analyzing the gathered data and information, market values and market sizing is determined using reliable sources. The market estimation is carried out using a combination of top-down and bottom-up approaches. The top-down approach utilized the total market value and then divided the same into applications and regions to obtain the individual segment value. Similarly, the bottom-up approach utilized the individual segment values, obtained through primary and secondary research, and then consolidated these values to obtain the total market value. These two approaches together were then used to check for any discrepancies and for arriving at a more realistic market estimation.

Key Findings

The analysis conducted provides valuable insights regarding the current state of the global Solid-State Drives (SSD) market. The key drivers for this market are the increasing demand for data storage, the rising demand for high-performance storage devices, and the increasing popularity of mobile devices. Additionally, the emergence of new technological advancements is expected to create long-term opportunities for market expansion.

Conclusion

This study provides a comprehensive understanding of the current state of the global Solid-State Drives (SSD) market. Furthermore, the study explores market drivers and restraints and identified market opportunities for growth. Also, the study provides an estimate of market size and value for the next 5 years. This report can help provide valuable insights for new entrants as well as existing players in this industry. The study also helps to gain insights into the current competitive landscape and understand the dynamics of the market.