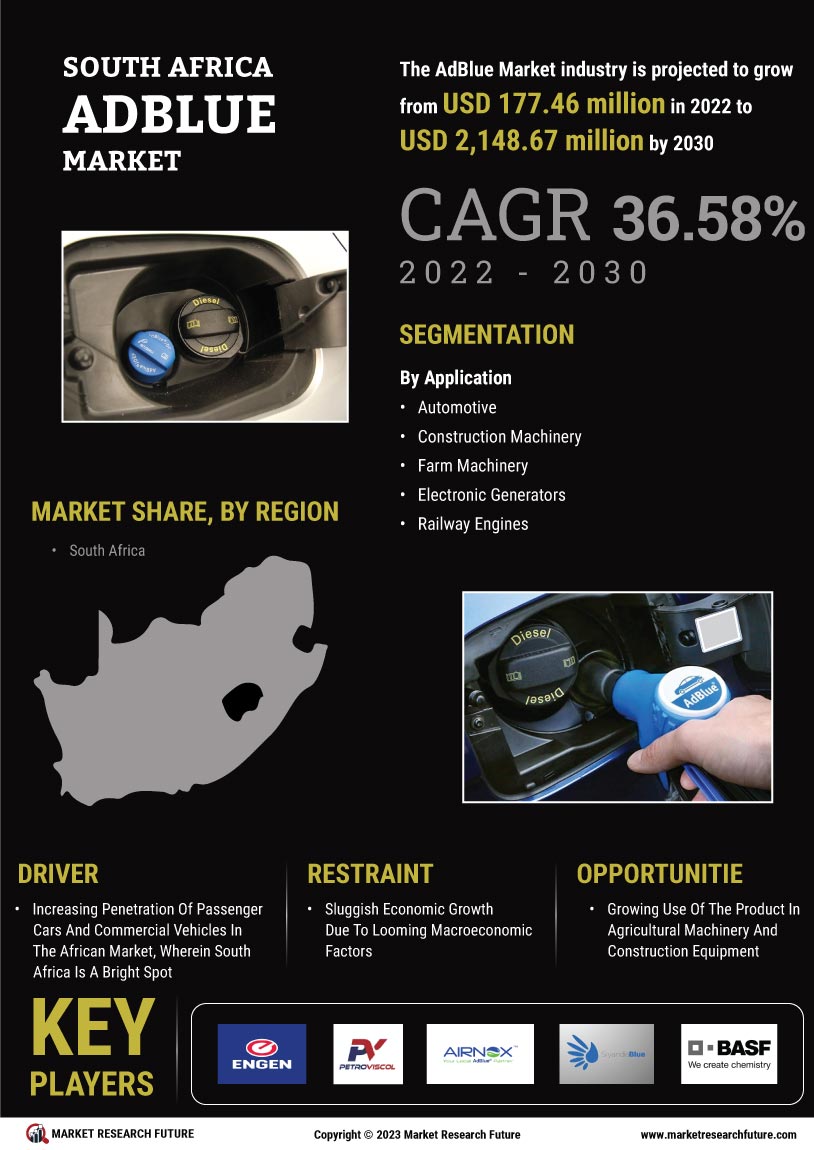

Rising Diesel Vehicle Population

The South Africa Adblue Market is experiencing growth due to the rising population of diesel vehicles. As of October 2025, diesel vehicles account for a substantial share of the automotive market, with many consumers opting for diesel engines due to their fuel efficiency and lower carbon emissions. This trend is further supported by the increasing number of commercial vehicles, which predominantly use diesel engines. Consequently, the demand for Adblue, a critical component in reducing harmful emissions from these vehicles, is expected to rise. Market data indicates that the diesel vehicle segment is projected to grow by approximately 5% annually, thereby enhancing the prospects for the Adblue market in South Africa.

Technological Innovations in Production

Technological innovations in the production of Adblue are shaping the South Africa Adblue Market. Advances in manufacturing processes have led to more efficient production methods, reducing costs and improving the quality of Adblue. As of October 2025, several local manufacturers are adopting state-of-the-art technologies to enhance their production capabilities. This not only ensures a steady supply of high-quality Adblue but also positions South African producers competitively in the regional market. Furthermore, these innovations may lead to the development of new formulations that cater to specific consumer needs, thereby expanding the market reach and driving growth in the Adblue sector.

Increased Awareness of Environmental Issues

The South Africa Adblue Market is benefiting from increased awareness of environmental issues among consumers and businesses. As public consciousness regarding air quality and environmental sustainability grows, there is a notable shift towards adopting cleaner technologies. This heightened awareness is prompting fleet operators and individual consumers to seek out Adblue as a solution to meet emission standards. Market surveys indicate that a significant percentage of consumers are now more informed about the benefits of using Adblue, which is likely to drive demand. This trend suggests a promising future for the Adblue market, as stakeholders recognize the importance of reducing their environmental footprint.

Economic Growth and Infrastructure Development

Economic growth and infrastructure development are pivotal drivers of the South Africa Adblue Market. As the economy expands, there is a corresponding increase in transportation and logistics activities, which predominantly rely on diesel-powered vehicles. The South African government is investing in infrastructure projects, which are expected to boost the demand for commercial vehicles and, consequently, Adblue. As of October 2025, projections indicate that infrastructure development will lead to a 6% increase in diesel vehicle registrations, thereby enhancing the market for Adblue. This economic momentum not only supports the growth of the Adblue market but also encourages investment in cleaner technologies, aligning with global sustainability goals.

Regulatory Compliance and Environmental Standards

The South Africa Adblue Market is significantly influenced by stringent regulatory compliance and environmental standards. The government has implemented various regulations aimed at reducing nitrogen oxide emissions from diesel vehicles, which has led to an increased demand for Adblue. As of October 2025, the South African government continues to enforce these regulations, compelling transport and logistics companies to adopt cleaner technologies. This regulatory landscape not only drives the market but also encourages manufacturers to innovate and improve their Adblue formulations. The adherence to these standards is crucial for companies seeking to maintain their operational licenses and avoid penalties, thereby fostering a robust market for Adblue in South Africa.