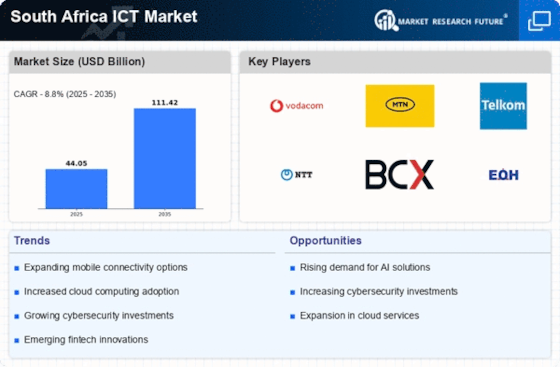

Emergence of Fintech Solutions

The emergence of fintech solutions is a transformative driver for the South Africa ICT Market. With a significant portion of the population remaining unbanked, fintech companies are leveraging technology to provide financial services to underserved communities. Recent reports suggest that the fintech sector in South Africa is projected to grow at a compound annual growth rate of over 20% in the coming years. This growth is likely to spur demand for ICT services, including mobile payment systems, digital banking, and blockchain technology. As fintech continues to evolve, it presents substantial opportunities for ICT providers to collaborate and innovate, ultimately enhancing financial inclusion across the country.

Adoption of Digital Transformation

The ongoing adoption of digital transformation across various industries is significantly influencing the South Africa ICT Market. Organizations are increasingly recognizing the need to integrate digital technologies into their operations to enhance efficiency and customer engagement. According to recent data, approximately 70% of South African businesses are investing in digital tools and platforms. This trend is likely to drive demand for ICT services, including cloud computing, data analytics, and artificial intelligence. As companies strive to remain competitive, the emphasis on digital transformation is expected to create new opportunities for ICT providers, fostering innovation and growth within the market.

Government Initiatives and Policies

Government initiatives and policies aimed at promoting the ICT sector are crucial drivers for the South Africa ICT Market. The South African government has implemented various strategies to enhance the digital economy, including the National Development Plan, which emphasizes the importance of ICT in driving economic growth. Additionally, initiatives such as the Digital Economy Strategy aim to improve access to technology and foster innovation. These policies are likely to attract both local and foreign investment, further stimulating the ICT sector. As a result, the South Africa ICT Market may experience accelerated growth, with increased opportunities for startups and established companies alike.

Expansion of Internet Infrastructure

The expansion of internet infrastructure in South Africa is a pivotal driver for the South Africa ICT Market. With the government and private sector investing heavily in broadband connectivity, the number of internet users is projected to reach over 40 million by 2025. This increased connectivity facilitates access to digital services, enhancing the overall ICT ecosystem. Moreover, the rollout of fiber-optic networks and 5G technology is expected to improve internet speeds and reliability, further stimulating growth in various sectors. As businesses and consumers increasingly rely on digital platforms, the demand for innovative ICT solutions is likely to surge, positioning South Africa as a competitive player in the regional ICT landscape.

Growing Demand for E-Government Services

The growing demand for e-government services is reshaping the South Africa ICT Market. Citizens increasingly expect efficient and accessible digital services from their government, prompting a shift towards online platforms for service delivery. Recent statistics indicate that over 60% of South Africans prefer using digital channels for government interactions. This trend is likely to drive investments in ICT solutions that enhance service delivery, transparency, and citizen engagement. As the government continues to prioritize digital transformation, the demand for innovative ICT services is expected to rise, creating opportunities for technology providers to develop tailored solutions for public sector needs.