Growing Focus on Smart Cities

The concept of smart cities is gaining traction in South America, driving the agile IoT market forward. Urban areas are increasingly adopting IoT technologies to enhance public services, improve energy efficiency, and optimize transportation systems. By 2025, it is anticipated that investments in smart city projects will exceed $5 billion in the region. This focus on urban innovation is likely to create a substantial demand for agile IoT solutions, as municipalities seek to implement systems that can adapt to changing needs and improve the quality of life for residents. The agile IoT market is thus positioned to thrive in this evolving landscape.

Government Initiatives and Support

Government initiatives play a crucial role in shaping the agile IoT market in South America. Various national and regional policies are being implemented to promote the adoption of IoT technologies across different sectors. For instance, funding programs and tax incentives are being introduced to encourage businesses to invest in agile IoT solutions. In 2025, it is estimated that government spending on IoT-related projects in South America will reach approximately $1 billion, reflecting a commitment to fostering innovation and technological advancement. This supportive environment is likely to stimulate growth in the agile IoT market, as companies are more inclined to adopt new technologies when backed by governmental support.

Increased Investment in Cybersecurity

As the agile IoT market expands in South America, the need for robust cybersecurity measures becomes increasingly critical. With the proliferation of connected devices, businesses are recognizing the potential risks associated with data breaches and cyberattacks. In response, investments in cybersecurity solutions are projected to grow by 40% over the next few years. This heightened focus on security is likely to drive the adoption of agile IoT technologies, as companies seek to ensure the integrity and safety of their data. The agile IoT market is expected to benefit from this trend, as organizations prioritize secure and resilient IoT deployments.

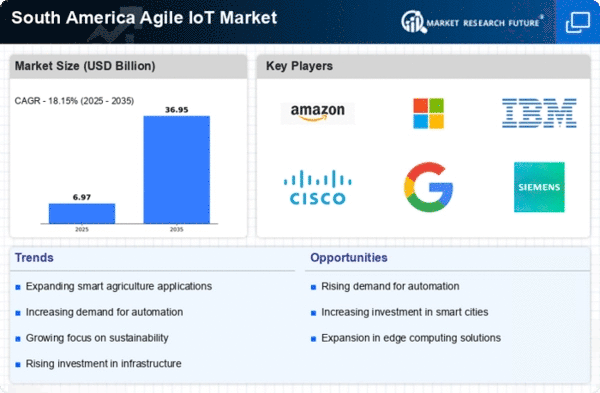

Rising Demand for Real-Time Data Analytics

The agile IoT market in South America experiences a notable surge in demand for real-time data analytics. Businesses across various sectors are increasingly recognizing the value of immediate insights derived from IoT devices. This trend is particularly pronounced in industries such as agriculture and manufacturing, where timely data can enhance decision-making processes. According to recent estimates, the market for data analytics in the region is projected to grow at a CAGR of 25% over the next five years. This growth is likely to drive investments in agile IoT solutions, as companies seek to leverage data for operational efficiency and competitive advantage. The agile IoT market is thus positioned to benefit significantly from this rising demand, as organizations prioritize agility and responsiveness in their operations.

Expansion of Telecommunications Infrastructure

The expansion of telecommunications infrastructure in South America is a significant driver for the agile IoT market. Improved connectivity, particularly in rural and underserved areas, facilitates the deployment of IoT devices and applications. As of November 2025, it is reported that mobile broadband coverage has increased to over 80% in many regions, enabling more businesses to leverage IoT technologies. This enhanced connectivity is expected to lead to a 30% increase in IoT device adoption in the next few years. Consequently, the agile IoT market stands to gain from this infrastructure development, as it allows for more robust and reliable IoT solutions.