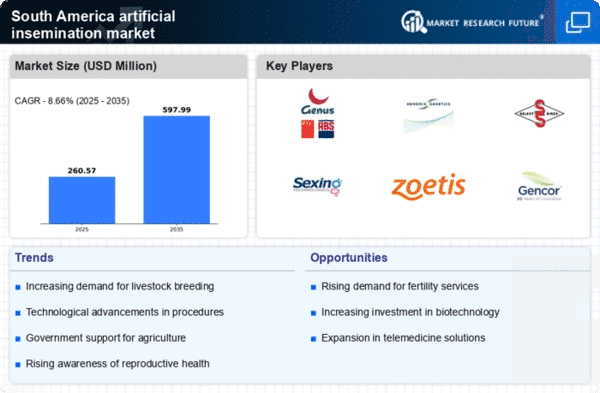

Rising Livestock Population

The increasing livestock population in South America is a crucial driver for the artificial insemination market. As the demand for meat and dairy products rises, farmers are seeking efficient breeding methods to enhance productivity. In 2025, the livestock population in South America is projected to reach approximately 300 million head, indicating a growth of around 5% from previous years. This surge necessitates advanced reproductive technologies, such as artificial insemination, to improve genetic quality and yield. Farmers are increasingly adopting these methods to ensure better herd management and profitability. The artificial insemination market is thus positioned to benefit from this trend, as it provides solutions that align with the agricultural sector's goals of sustainability and efficiency.

Supportive Regulatory Frameworks

Supportive regulatory frameworks in South America are fostering the growth of the artificial insemination market. Governments are implementing policies that promote the use of artificial insemination as a means to enhance livestock productivity and genetic diversity. In 2025, it is anticipated that several countries in the region will introduce incentives for farmers to adopt artificial insemination practices, potentially increasing market participation by 15%. These regulations not only encourage the adoption of advanced reproductive technologies but also ensure that farmers have access to necessary training and resources. Consequently, the artificial insemination market is likely to thrive as a result of these supportive measures that align with agricultural development goals.

Rising Demand for Sustainable Practices

The rising demand for sustainable agricultural practices is significantly influencing the artificial insemination market in South America. Consumers are increasingly concerned about the environmental impact of livestock production, prompting farmers to adopt more sustainable breeding methods. Artificial insemination offers a way to improve herd genetics while minimizing resource use and environmental footprint. In 2025, it is estimated that around 30% of livestock producers will prioritize sustainability in their breeding programs, leading to a greater reliance on artificial insemination techniques. This shift indicates a potential growth area for the artificial insemination market, as it aligns with the broader trend towards sustainable agriculture and responsible food production.

Increased Awareness of Genetic Improvement

There is a growing awareness among farmers in South America regarding the benefits of genetic improvement through artificial insemination. This awareness is driving the artificial insemination market as producers recognize the potential for enhanced traits such as disease resistance, growth rate, and milk production. In 2025, it is estimated that around 60% of livestock producers in the region are utilizing artificial insemination techniques, reflecting a significant increase from previous years. This trend suggests that farmers are more inclined to invest in advanced reproductive technologies to achieve superior genetic outcomes. Consequently, the artificial insemination market is likely to expand as more producers seek to optimize their herds and meet the rising consumer demand for high-quality animal products.

Technological Integration in Farming Practices

The integration of technology in farming practices is transforming the artificial insemination market in South America. Innovations such as precision agriculture, data analytics, and reproductive technologies are enhancing the efficiency of artificial insemination processes. In 2025, it is projected that approximately 40% of farms in the region will adopt these technologies, leading to improved breeding outcomes and reduced costs. This technological shift allows farmers to monitor reproductive cycles more accurately and manage insemination timing effectively. As a result, the artificial insemination market is likely to experience growth driven by the demand for more efficient and effective breeding solutions that leverage modern technology.