Rising Awareness of Genetic Testing

There is a growing awareness of the benefits of genetic testing among the South American population, which is significantly impacting the biochips market. As individuals become more informed about the role of genetics in health, the demand for biochip-based genetic testing solutions is likely to increase. This trend is supported by educational campaigns and initiatives aimed at promoting personalized medicine. The market for genetic testing in South America is projected to reach $1 billion by 2027, indicating a robust growth trajectory. Consequently, biochip manufacturers are expected to capitalize on this trend by developing advanced genetic testing solutions that cater to the evolving needs of consumers.

Growing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in South America is a critical driver for the biochips market. Conditions such as diabetes, cancer, and cardiovascular diseases are becoming increasingly prevalent, necessitating advanced diagnostic tools. Biochips offer rapid and accurate testing capabilities, which are essential for effective disease management. According to recent health statistics, chronic diseases account for over 70% of total deaths in the region. This alarming trend is prompting healthcare providers to adopt biochip technologies to enhance patient care and streamline diagnostic processes. Consequently, the demand for biochips is expected to grow significantly as healthcare systems seek to implement more efficient and effective solutions.

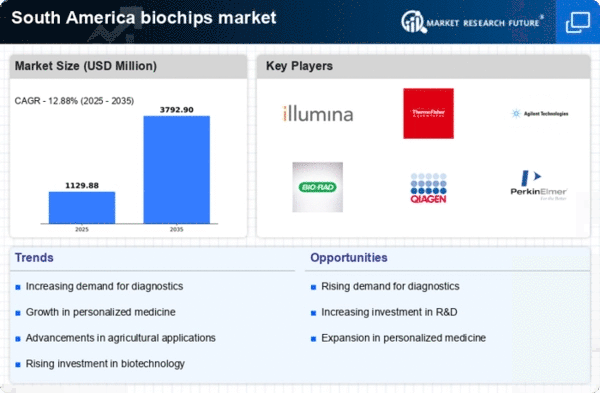

Increasing Investment in Biotechnology

The biochips market in South America is experiencing a surge in investment, particularly from both public and private sectors. Governments are recognizing the potential of biotechnology to drive economic growth and improve healthcare outcomes. For instance, Brazil has allocated approximately $200 million to support biotechnology research and development initiatives. This influx of capital is likely to enhance the capabilities of biochip manufacturers, enabling them to innovate and expand their product offerings. Furthermore, as the region's biotechnology sector matures, it is expected that the biochips market will benefit from increased collaboration between academic institutions and industry players, fostering a more robust ecosystem for biochip development.

Regulatory Support for Innovative Technologies

Regulatory frameworks in South America are evolving to support the adoption of innovative technologies, including biochips. Authorities are increasingly recognizing the importance of biochips in enhancing diagnostic accuracy and patient outcomes. For example, Brazil's National Health Surveillance Agency has introduced streamlined approval processes for biochip-based diagnostics, which could reduce time-to-market for new products. This regulatory support is likely to encourage more companies to invest in biochip development, thereby expanding the market. As a result, the biochips market is poised for growth, driven by a favorable regulatory environment that promotes innovation and ensures safety.

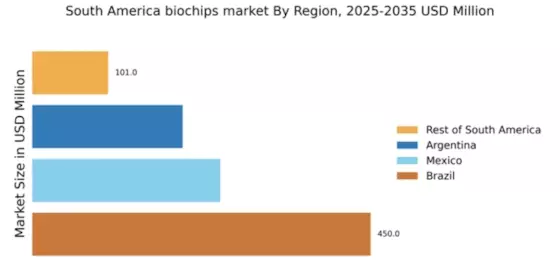

Expansion of Research and Development Facilities

The establishment of new research and development facilities across South America is a pivotal driver for the biochips market. Countries like Argentina and Chile are investing in state-of-the-art laboratories and research centers to foster innovation in biotechnology. This expansion is likely to facilitate the development of novel biochip technologies, enhancing the region's competitive edge in the global market. Moreover, increased R&D activities are expected to lead to breakthroughs in biochip applications, ranging from diagnostics to environmental monitoring. As these facilities become operational, they will contribute to the growth of the biochips market by producing cutting-edge solutions that meet the demands of various industries.

Leave a Comment