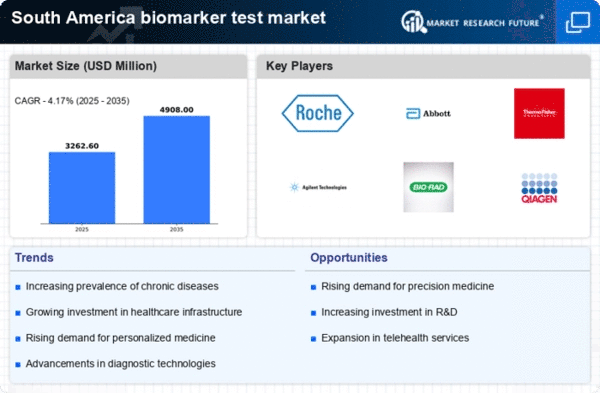

Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in South America is a pivotal driver for the biomarker test market. Conditions such as diabetes, cardiovascular diseases, and cancer are becoming more prevalent, necessitating advanced diagnostic tools. According to health statistics, chronic diseases account for approximately 70% of all deaths in the region. This alarming trend propels healthcare providers to seek innovative solutions, including biomarker tests, to enhance early detection and personalized treatment strategies. The biomarker test market is thus positioned to expand as healthcare systems adapt to these challenges, aiming to improve patient outcomes and reduce healthcare costs.

Regulatory Changes Favoring Innovation

Recent regulatory changes in South America are creating a more favorable environment for the biomarker test market. Authorities are streamlining approval processes for new diagnostic tests, which encourages innovation and expedites the introduction of novel biomarker tests. This regulatory shift is particularly evident in countries like Chile and Colombia, where governments are actively promoting the adoption of advanced diagnostic technologies. As a result, the biomarker test market is likely to experience accelerated growth, as companies can bring their products to market more efficiently, ultimately benefiting patients and healthcare providers alike.

Advancements in Research and Development

Ongoing advancements in research and development within the biomarker test market are crucial for its growth in South America. Academic institutions and biotech companies are increasingly collaborating to discover new biomarkers and improve existing testing methodologies. This collaborative environment is fostering innovation, with research funding reportedly increasing by 10% annually in the region. Such advancements not only enhance the accuracy and reliability of biomarker tests but also expand their applications across various diseases, thereby attracting more investment and interest in the market.

Increased Awareness of Preventive Healthcare

There is a notable rise in awareness regarding preventive healthcare among the South American population, which is driving the biomarker test market. As individuals become more informed about the benefits of early disease detection, the demand for biomarker tests is likely to increase. Public health campaigns and educational initiatives are contributing to this trend, emphasizing the importance of regular health screenings. The biomarker test market stands to benefit from this shift, as more people seek out tests that can provide insights into their health status and potential risks, thereby promoting proactive healthcare measures.

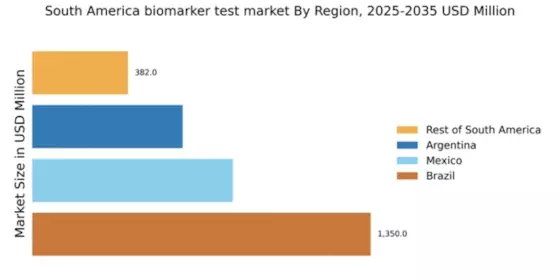

Growing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is significantly influencing the biomarker test market. Governments and private entities are channeling funds into modernizing laboratories and diagnostic facilities, which enhances the capacity for biomarker testing. For instance, Brazil and Argentina have seen substantial increases in healthcare spending, with projections indicating a growth rate of around 5% annually. This investment not only improves access to advanced diagnostic tools but also fosters research and development in the biomarker test market, ultimately leading to better healthcare delivery and patient management.