Advancements in Biotechnology

Technological advancements in biotechnology are playing a pivotal role in shaping the biopharmaceuticals market in South America. Innovations in genetic engineering, monoclonal antibody production, and cell therapy are enhancing the development of new biopharmaceutical products. For instance, the introduction of CRISPR technology has revolutionized gene editing, allowing for more precise and effective treatments. As a result, the biopharmaceuticals market is expected to expand, with projections indicating a market value of $20 billion by 2026. These advancements not only improve treatment outcomes but also reduce production costs, making biopharmaceuticals more accessible to the South American population.

Increasing Demand for Biologics

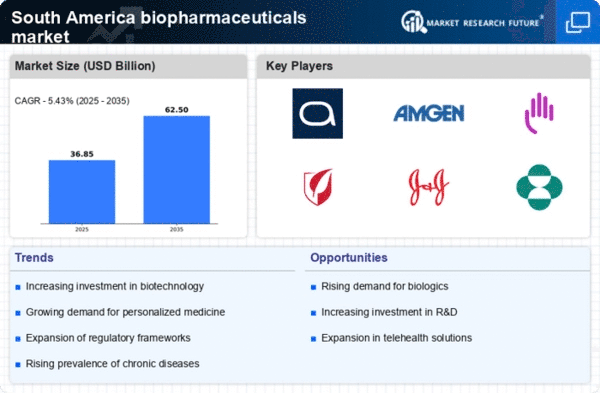

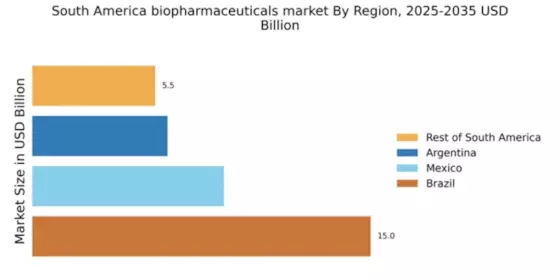

The biopharmaceuticals market in South America is experiencing a notable surge in demand for biologics, driven by their efficacy in treating chronic diseases. As healthcare providers and patients increasingly recognize the advantages of biologics over traditional therapies, the market is projected to grow significantly. In 2025, the market for biologics in South America is estimated to reach approximately $15 billion, reflecting a compound annual growth rate (CAGR) of around 10%. This trend is further supported by the rising prevalence of conditions such as cancer and autoimmune disorders, which require innovative treatment options. Consequently, the increasing demand for biologics is a critical driver for the biopharmaceuticals market in the region.

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases in South America is a significant driver for the biopharmaceuticals market. Conditions such as diabetes, cardiovascular diseases, and cancer are becoming more common, necessitating the development of effective treatment options. According to recent statistics, chronic diseases account for approximately 70% of all deaths in the region, highlighting the urgent need for innovative therapies. This growing health crisis is prompting both public and private sectors to invest in biopharmaceutical research and development. As a result, the biopharmaceuticals market is expected to expand, with a projected value of $22 billion by 2028, driven by the demand for targeted and effective treatments.

Growing Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a significant driver for the biopharmaceuticals market in South America. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, improve access to medications, and support research initiatives. In 2025, healthcare spending in South America is projected to reach $500 billion, with a substantial portion directed towards biopharmaceuticals. This investment is crucial for fostering innovation and ensuring that biopharmaceutical products are available to meet the growing healthcare needs of the population. Enhanced infrastructure not only supports the development of new therapies but also facilitates better distribution and accessibility of existing biopharmaceuticals.

Regulatory Support for Biopharmaceutical Innovation

The regulatory environment in South America is evolving to support biopharmaceutical innovation, which is a key driver for the market. Regulatory agencies are streamlining approval processes for new biopharmaceutical products, thereby encouraging research and development. In recent years, several countries in the region have implemented policies aimed at expediting the approval of innovative therapies. This regulatory support is expected to result in a more favorable environment for biopharmaceutical companies, potentially increasing the number of new product launches. As a consequence, the biopharmaceuticals market is likely to witness accelerated growth, with an anticipated market size of $18 billion by 2027.