Expansion of E-commerce Platforms

The expansion of e-commerce platforms is transforming the chemical distribution market in South America. Businesses increasingly turn to online channels for procurement. As businesses increasingly turn to online channels for procurement, distributors are compelled to enhance their digital presence and streamline their operations. This shift not only broadens the customer base but also allows for more efficient order processing and delivery. Recent statistics indicate that online sales in the chemical sector are expected to grow by 20% annually, reflecting a significant change in purchasing behavior. Distributors who invest in e-commerce capabilities may gain a competitive edge, as they can offer customers greater convenience and access to a wider range of products. This trend is likely to continue shaping the future of the chemical distribution market.

Growing Environmental Regulations

The chemical distribution market in South America is increasingly influenced by growing environmental regulations aimed at reducing pollution and promoting sustainable practices. Governments are implementing stricter guidelines regarding the handling, storage, and transportation of chemicals, which compels distributors to adopt more environmentally friendly practices. Compliance with these regulations often requires investment in new technologies and training for staff, which can be a challenge for smaller distributors. However, those who adapt effectively may find new opportunities in the market, as businesses seek suppliers who can demonstrate compliance and sustainability. This shift towards regulatory adherence is likely to reshape the competitive landscape of the chemical distribution market.

Infrastructure Development Projects

Infrastructure development projects across South America are significantly impacting the chemical distribution market. Governments and private sectors are investing heavily in construction, transportation, and energy sectors, which in turn increases the demand for construction chemicals, coatings, and adhesives. For example, the construction industry is expected to grow by 4.2% annually, leading to a heightened need for chemical products that support these projects. This surge in infrastructure initiatives not only boosts the volume of chemicals distributed but also encourages distributors to establish strategic partnerships with manufacturers to ensure timely delivery and compliance with project specifications. As a result, the chemical distribution market is poised for growth, driven by these infrastructural advancements.

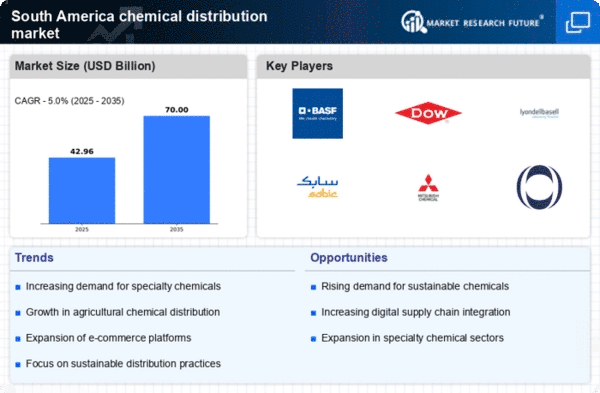

Rising Demand for Specialty Chemicals

The chemical distribution market in South America experiences a notable increase in demand for specialty chemicals. This demand is driven by various industries such as agriculture, pharmaceuticals, and personal care. This trend is likely influenced by the growing need for customized solutions that cater to specific applications. For instance, the agricultural sector is increasingly utilizing specialty fertilizers and pesticides to enhance crop yields. According to recent data, the specialty chemicals segment is projected to grow at a CAGR of approximately 5.5% from 2025 to 2030. This growth indicates a shift in consumer preferences towards high-performance products, thereby creating opportunities for distributors to expand their portfolios and enhance their service offerings in the chemical distribution market.

Technological Advancements in Logistics

Technological advancements in logistics are reshaping the chemical distribution market in South America. The adoption of automation, real-time tracking systems, and data analytics is enhancing supply chain efficiency and reducing operational costs. For instance, the implementation of advanced inventory management systems allows distributors to optimize stock levels and minimize waste. This is particularly crucial in the chemical distribution market, where product shelf life and safety are paramount. Moreover, the integration of digital platforms facilitates better communication between suppliers and customers, ensuring timely deliveries and improved service levels. As logistics technology continues to evolve, it is likely to play a pivotal role in enhancing the competitiveness of chemical distributors in the region.