Rising Incidence of Cancer

The increasing incidence of cancer in South America is a primary driver for the circulating tumor-cell market. According to recent statistics, cancer cases in the region have escalated, with projections indicating a rise of approximately 20% over the next decade. This surge necessitates advanced diagnostic and monitoring solutions, thereby propelling the demand for circulating tumor-cell technologies. As healthcare systems strive to enhance cancer management, the circulating tumor-cell market is positioned to benefit significantly. The need for early detection and personalized treatment options is becoming more pronounced, leading to a greater focus on innovative technologies that can provide real-time insights into tumor dynamics. Consequently, the growth of the cancer patient population is likely to stimulate investments in research and development, further driving the expansion of the circulating tumor-cell market in South America.

Government Initiatives and Funding

Government initiatives aimed at enhancing cancer research and treatment accessibility are significantly influencing the circulating tumor-cell market in South America. Various national health programs are being implemented to allocate funding for cancer research, which includes the development of circulating tumor-cell technologies. For example, recent government reports indicate an increase in funding by approximately 30% for cancer-related research initiatives. This financial support is crucial for fostering innovation and facilitating clinical trials that explore the efficacy of circulating tumor-cell applications. As governments prioritize cancer care, the circulating tumor-cell market stands to gain from increased investment in research and development, ultimately leading to improved diagnostic and therapeutic options for patients across the region.

Advancements in Diagnostic Technologies

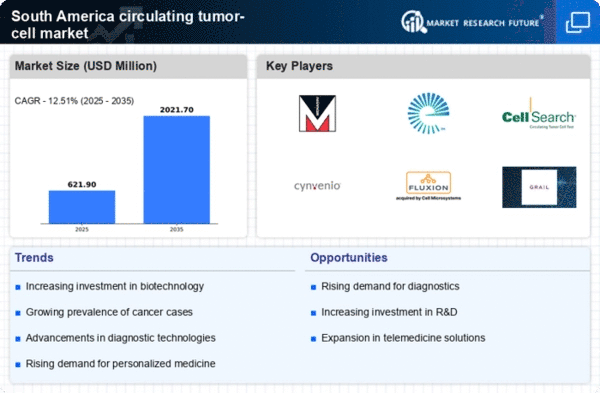

Technological innovations in diagnostic methodologies are transforming the landscape of the circulating tumor-cell market in South America. The integration of advanced imaging techniques and molecular diagnostics has enhanced the accuracy and efficiency of cancer detection. For instance, liquid biopsy technologies, which analyze circulating tumor cells, are gaining traction due to their non-invasive nature and ability to provide critical information about tumor characteristics. The market for these technologies is projected to grow at a CAGR of around 15% over the next five years. This growth is indicative of the increasing reliance on precision medicine and personalized treatment strategies. As healthcare providers seek to adopt cutting-edge diagnostic tools, the circulating tumor-cell market is likely to experience substantial growth, driven by the demand for innovative solutions that improve patient outcomes and streamline treatment protocols.

Growing Demand for Personalized Medicine

The shift towards personalized medicine is reshaping the circulating tumor-cell market in South America. Patients and healthcare providers are increasingly recognizing the value of tailored treatment approaches that consider individual tumor profiles. This trend is driving the demand for circulating tumor-cell technologies, which enable clinicians to monitor treatment responses and adjust therapies accordingly. Market analysts project that the personalized medicine segment will account for a substantial share of the circulating tumor-cell market, with an expected growth rate of around 18% annually. This growth reflects a broader movement towards individualized healthcare solutions that enhance treatment efficacy and minimize adverse effects. As the healthcare landscape evolves, the emphasis on personalized medicine is likely to propel advancements in circulating tumor-cell technologies, fostering a more patient-centric approach to cancer care.

Increased Collaboration Between Academia and Industry

The collaboration between academic institutions and industry players is emerging as a vital driver for the circulating tumor-cell market in South America. Partnerships are being formed to facilitate research and development efforts focused on innovative circulating tumor-cell technologies. These collaborations often lead to the sharing of resources, expertise, and funding, which can accelerate the development of new diagnostic and therapeutic solutions. Recent reports suggest that joint ventures in the region have increased by approximately 25% in the past few years, highlighting the growing recognition of the importance of collaborative efforts in advancing cancer research. As academia and industry work together to address the challenges of cancer treatment, the circulating tumor-cell market is likely to benefit from enhanced innovation and a more robust pipeline of products and services.