Focus on Personalized Medicine

The clinical laboratory-services market in South America is increasingly aligning with the global trend towards personalized medicine, which emphasizes tailored healthcare solutions based on individual patient profiles. This approach is gaining traction as healthcare providers recognize the importance of genetic testing and biomarker analysis in developing effective treatment plans. The market for personalized medicine is expected to grow by 10% annually, driven by advancements in genomics and biotechnology. As clinical laboratories enhance their capabilities to offer specialized tests, they are likely to attract more healthcare providers seeking to implement personalized treatment strategies. This focus on individualized care is anticipated to significantly impact the clinical laboratory-services market, fostering innovation and expanding service offerings.

Increasing Healthcare Expenditure

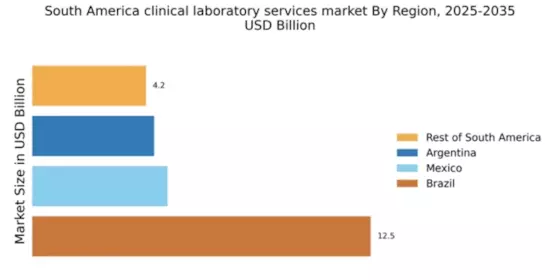

The clinical laboratory-services market in South America is experiencing growth driven by rising healthcare expenditure across various countries. Governments and private sectors are investing more in healthcare infrastructure, which includes laboratory services. For instance, Brazil's healthcare spending is projected to reach approximately $200 billion by 2025, indicating a robust commitment to enhancing healthcare services. This increase in funding allows for the expansion of clinical laboratories, improved technology, and better service delivery. As healthcare budgets grow, the demand for laboratory services is likely to rise, thereby propelling the clinical laboratory-services market forward. Furthermore, the focus on improving healthcare access in rural areas is expected to create additional opportunities for laboratory service providers, enhancing their market presence and capabilities.

Expansion of Health Insurance Coverage

The clinical laboratory-services market in South America is benefiting from the expansion of health insurance coverage, which is making laboratory services more accessible to a larger segment of the population. Countries like Argentina and Colombia are implementing reforms to increase insurance penetration, which is projected to rise to 80% by 2025. This expansion is likely to lead to a higher utilization of clinical laboratory services, as insured patients are more inclined to seek preventive and diagnostic testing. Consequently, the clinical laboratory-services market is expected to experience a boost in demand, as more individuals gain access to necessary laboratory tests without the burden of high out-of-pocket costs. This trend may also encourage laboratories to diversify their service offerings to cater to a broader patient base.

Growing Prevalence of Chronic Diseases

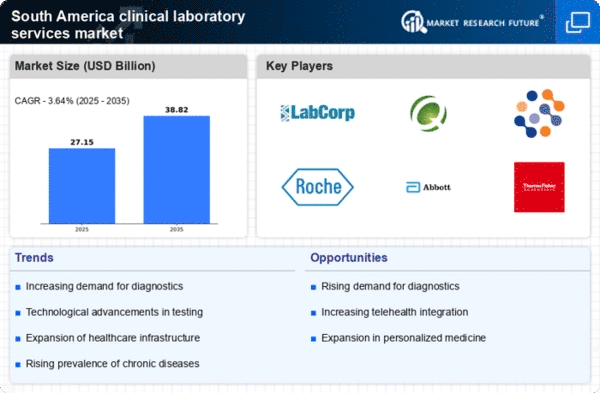

The clinical laboratory-services market in South America is significantly influenced by the growing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer. According to recent statistics, chronic diseases account for nearly 70% of all deaths in the region, necessitating increased diagnostic testing and monitoring. This trend is prompting healthcare providers to rely more on clinical laboratories for accurate and timely diagnoses. As a result, the demand for laboratory services is expected to surge, with an estimated market growth rate of 8% annually over the next five years. The increasing burden of chronic diseases is likely to drive investments in laboratory technologies and services, thereby enhancing the overall clinical laboratory-services market.

Technological Integration in Laboratory Services

The clinical laboratory-services market in South America is witnessing a transformative phase due to the integration of advanced technologies such as automation, artificial intelligence, and telemedicine. These innovations are enhancing the efficiency and accuracy of laboratory testing, which is crucial for timely diagnosis and treatment. For example, automated systems can reduce turnaround times for test results, thereby improving patient outcomes. The market is projected to grow at a CAGR of 7% as laboratories adopt these technologies to streamline operations and reduce costs. Furthermore, the rise of telemedicine is facilitating remote consultations, which may increase the demand for laboratory tests as patients seek convenient healthcare solutions. This technological shift is likely to redefine the landscape of the clinical laboratory-services market.