Consumer Awareness of Food Safety

Consumer awareness regarding food safety and quality is a crucial driver for the cold chain-monitoring market. As consumers become more informed about the risks associated with improper handling of perishable goods, they are demanding higher standards from retailers and suppliers. This trend is prompting businesses to implement advanced monitoring systems to ensure compliance with safety regulations. In South America, surveys indicate that over 70% of consumers prioritize food safety when making purchasing decisions. Consequently, the cold chain-monitoring market is likely to experience growth as companies invest in technologies that provide real-time data on temperature and humidity levels, thereby enhancing consumer trust.

Regulatory Pressure for Compliance

Regulatory pressure for compliance with food safety and quality standards is a driving force in the cold chain-monitoring market. Governments in South America are implementing stricter regulations to ensure the safety of food and pharmaceutical products, which necessitates the adoption of effective monitoring solutions. Companies are increasingly required to demonstrate compliance through accurate temperature tracking and reporting. This regulatory landscape is likely to propel the cold chain-monitoring market, as businesses invest in systems that facilitate adherence to these standards. By 2025, it is anticipated that compliance-related investments will account for a significant portion of the market, highlighting the importance of regulatory frameworks in shaping industry dynamics.

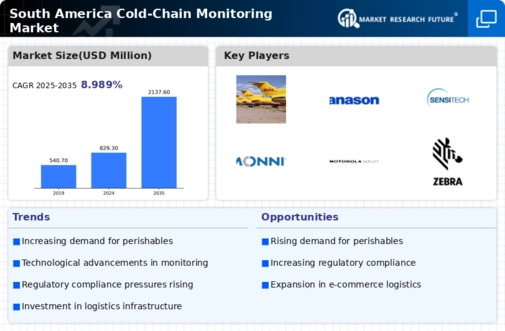

Rising Demand for Perishable Goods

The increasing consumption of perishable goods in South America is a key driver for the cold chain-monitoring market. As urbanization accelerates, consumers are seeking fresh produce, dairy, and meat products, which necessitate stringent temperature control during transportation and storage. The cold chain-monitoring market is expected to benefit from this trend, as businesses invest in advanced monitoring solutions to ensure product quality and safety. In 2025, the demand for perishable goods is projected to grow by approximately 15%, further emphasizing the need for effective cold chain management. This growth is likely to compel stakeholders to adopt innovative technologies that enhance visibility and traceability throughout the supply chain.

Increased Investment in Infrastructure

Investment in cold chain infrastructure across South America is a significant driver for the cold chain-monitoring market. Governments and private entities are recognizing the importance of robust cold storage facilities and transportation networks to support the growing food and pharmaceutical sectors. In recent years, funding for cold chain projects has surged, with estimates suggesting an increase of over 20% in capital allocation by 2025. This investment is likely to enhance the efficiency of cold chain operations, thereby driving the demand for monitoring solutions that ensure compliance with safety standards. The cold chain-monitoring market stands to gain from these developments as stakeholders seek to optimize their logistics and reduce spoilage.

Technological Integration in Supply Chains

The integration of advanced technologies such as IoT and blockchain into supply chains is transforming the cold chain-monitoring market. These technologies enable real-time tracking and monitoring of temperature-sensitive products, which is essential for maintaining quality and compliance. In South America, the adoption of IoT solutions is projected to increase by 30% by 2025, as businesses seek to enhance operational efficiency and reduce losses. The cold chain-monitoring market is poised to benefit from this technological shift, as companies leverage data analytics to optimize their logistics and improve decision-making processes. This trend indicates a growing reliance on technology to address the challenges of cold chain management.