Growing Demand for Aesthetic Enhancement

The cosmetic surgery market in South America experiences a notable increase in demand for aesthetic enhancement procedures. This trend is driven by a rising societal emphasis on physical appearance, particularly among younger demographics. Surveys indicate that approximately 40% of individuals aged 18-34 express interest in cosmetic procedures, reflecting a cultural shift towards self-improvement. Additionally, the proliferation of social media platforms amplifies the desire for enhanced looks, as individuals seek to present idealized versions of themselves online. The market is projected to grow at a CAGR of 8% over the next five years, indicating a robust expansion in the cosmetic surgery market. This growing demand is likely to encourage more clinics to offer a wider range of services, thereby increasing competition and innovation within the sector.

Influence of Celebrity Culture and Media

The influence of celebrity culture and media significantly impacts the cosmetic surgery market in South America. High-profile figures often openly discuss their cosmetic procedures, creating a perception that such enhancements are both desirable and attainable. This visibility can lead to increased inquiries and consultations, as individuals aspire to emulate their favorite celebrities. Reports suggest that regions with higher media exposure to celebrity culture see a 25% increase in cosmetic surgery consultations. Additionally, reality television shows focusing on transformations further normalize these procedures, making them more mainstream. As the cosmetic surgery market continues to evolve, the role of media and celebrity endorsements is likely to remain a powerful driver of consumer interest and engagement.

Rising Disposable Incomes and Affordability

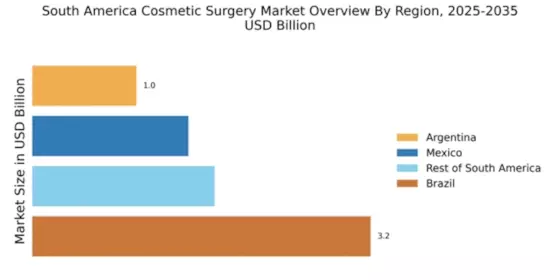

Rising disposable incomes across South America contribute to the growth of the cosmetic surgery market. As economic conditions improve, more individuals find themselves with the financial means to invest in aesthetic procedures. Data indicates that countries like Brazil and Argentina have seen a 15% increase in disposable income over the past three years, allowing a larger segment of the population to consider cosmetic enhancements. This trend is particularly evident among middle-class consumers, who are increasingly prioritizing personal appearance. The cosmetic surgery market is likely to see a shift in clientele demographics, with more individuals seeking services that were previously considered luxury items. This increased affordability may lead to a broader acceptance of cosmetic procedures as a norm rather than an exception.

Expansion of Specialized Clinics and Services

The expansion of specialized clinics and services is a notable driver in the cosmetic surgery market in South America. As consumer demand grows, more clinics are emerging, offering a diverse range of procedures tailored to specific needs. This proliferation of specialized services enhances accessibility for potential clients, allowing them to find options that suit their preferences and budgets. For instance, clinics focusing on non-invasive procedures have seen a surge in popularity, catering to individuals seeking less invasive options. The cosmetic surgery market is likely to benefit from this trend, as increased competition among clinics can lead to improved service quality and pricing strategies. Furthermore, the establishment of accredited facilities may enhance consumer trust, encouraging more individuals to pursue cosmetic enhancements.

Technological Advancements in Surgical Techniques

Technological advancements play a crucial role in shaping the cosmetic surgery market in South America. Innovations such as minimally invasive techniques, 3D imaging, and robotic-assisted surgeries enhance precision and reduce recovery times. For instance, the introduction of laser-assisted liposuction has gained popularity due to its effectiveness and reduced downtime. As a result, patient satisfaction rates have improved, with studies showing a 30% increase in positive outcomes. Furthermore, these advancements may lead to a broader acceptance of cosmetic procedures among the population, as individuals perceive them as safer and more effective. The cosmetic surgery market is likely to benefit from these technological improvements, as they not only attract new clients but also encourage existing patients to consider additional procedures.