Rising Disposable Income

The growing disposable income among the South American population is influencing the dental suture market positively. As individuals experience an increase in their financial capacity, they are more inclined to invest in dental care, including surgical procedures that require sutures. This trend is particularly evident in urban areas, where disposable income has risen by approximately 20% over the past five years. The willingness to spend on quality dental services is likely to drive the demand for advanced suturing materials, thereby benefiting the dental suture market. Furthermore, as more people prioritize oral health, the market is expected to witness a significant uptick in the utilization of dental sutures in various procedures.

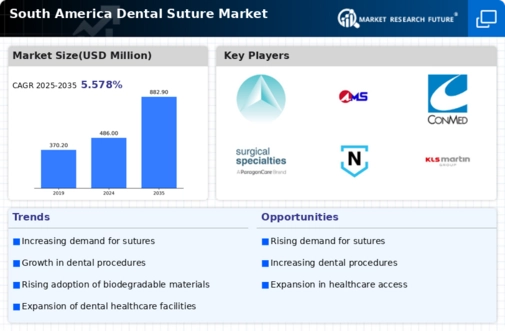

Increasing Dental Procedures

The rise in dental procedures across South America is a pivotal driver for the dental suture market. As oral health awareness increases, more individuals seek dental treatments, including surgeries that necessitate sutures. Reports indicate that dental procedures have surged by approximately 15% annually in several South American countries. This trend is likely to continue, as the population ages and the demand for cosmetic dentistry grows. Consequently, the dental suture market is expected to expand, driven by the need for effective and reliable suturing solutions in various dental surgeries. Moreover, the increasing prevalence of dental diseases further propels the demand for surgical interventions, thereby enhancing the market landscape for dental sutures.

Growing Awareness of Oral Health

The increasing awareness of oral health among the South American population is a crucial driver for the dental suture market. Educational campaigns and initiatives by health organizations have led to a heightened understanding of the importance of dental care. As a result, more individuals are seeking preventive and corrective dental treatments, which often involve surgical procedures requiring sutures. This trend is reflected in the rising number of dental visits, which has increased by approximately 10% in recent years. Consequently, the dental suture market is likely to benefit from this growing awareness, as the demand for effective suturing solutions in dental surgeries continues to rise.

Expansion of Dental Clinics and Facilities

The expansion of dental clinics and facilities across South America is significantly influencing the dental suture market. As more dental practices open, particularly in underserved areas, the accessibility of dental care improves, leading to an increase in surgical procedures that require sutures. Reports suggest that the number of dental clinics has grown by around 25% in the last five years, indicating a robust market environment. This proliferation of dental facilities is likely to drive the demand for various suturing materials, as practitioners seek reliable solutions for their surgical needs. Furthermore, the establishment of specialized dental centers is expected to enhance the market landscape for dental sutures, as these facilities often require advanced suturing techniques.

Technological Innovations in Dental Practices

Technological innovations within dental practices are significantly impacting the dental suture market. The introduction of advanced suturing techniques and materials enhances the efficiency and effectiveness of dental surgeries. For instance, the adoption of bioresorbable sutures is gaining traction, as they eliminate the need for suture removal and reduce patient discomfort. This shift towards innovative solutions is likely to increase the demand for specialized sutures, thereby expanding the market. Additionally, the integration of digital technologies in dental practices, such as 3D printing for custom sutures, is expected to further drive growth in the dental suture market. As dental professionals embrace these advancements, the market is poised for substantial development.

Leave a Comment