Growing Awareness of Oral Health

The increasing awareness of oral health among the UK population serves as a crucial driver for the dental suture market. Public health campaigns and educational initiatives have heightened the understanding of the importance of dental care, leading to more individuals seeking preventive and corrective dental treatments. This heightened awareness correlates with a rise in dental procedures, which often necessitate the use of sutures. As more patients opt for surgical interventions to maintain or restore their oral health, the demand for dental sutures is likely to increase. Consequently, the dental suture market is positioned to benefit from this growing consciousness regarding oral hygiene and its impact on overall health.

Rising Incidence of Dental Disorders

The prevalence of dental disorders in the UK is a significant driver for the dental suture market. With an increasing number of individuals experiencing conditions such as periodontal disease and dental trauma, the demand for surgical interventions rises correspondingly. According to recent health statistics, nearly 50% of adults in the UK have experienced some form of dental issue, necessitating surgical solutions that often require suturing. This growing incidence of dental problems propels the need for effective suturing materials and techniques, thereby stimulating market growth. The dental suture market is likely to benefit from this trend, as healthcare providers seek reliable and efficient suturing options to address the needs of their patients.

Regulatory Support for Dental Innovations

Regulatory frameworks in the UK are increasingly supportive of innovations within the dental suture market. Authorities are actively promoting the development and approval of new suturing materials and techniques that enhance patient safety and surgical efficacy. This regulatory environment encourages manufacturers to invest in research and development, leading to the introduction of novel suturing solutions. As a result, the market is likely to witness a diversification of product offerings, catering to various surgical needs. The proactive stance of regulatory bodies not only fosters innovation but also instills confidence among dental practitioners, thereby driving the growth of the dental suture market.

Technological Innovations in Dental Materials

Technological advancements in dental materials significantly influence the dental suture market. Innovations such as the development of advanced synthetic sutures, which offer enhanced biocompatibility and strength, are becoming increasingly prevalent. These materials not only improve surgical outcomes but also reduce the risk of complications, thereby appealing to dental practitioners. The introduction of smart sutures, which can monitor healing processes, represents a potential future direction for the market. As dental professionals become more aware of these innovations, the demand for high-quality sutures is expected to rise, further propelling the growth of the dental suture market. This trend indicates a shift towards more sophisticated and effective solutions in dental surgeries.

Increasing Demand for Minimally Invasive Procedures

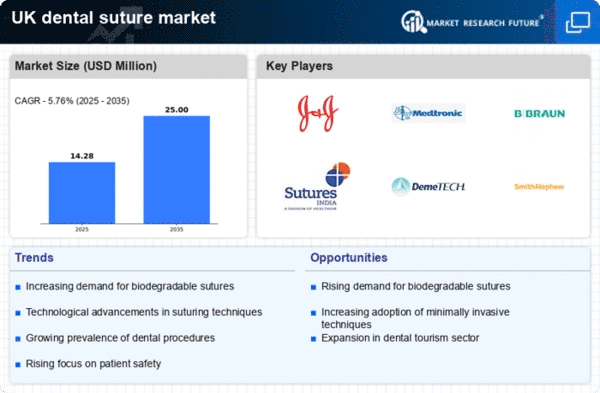

The dental suture market experiences a notable surge in demand due to the rising preference for minimally invasive surgical techniques. Patients increasingly seek procedures that promise reduced recovery times and less postoperative discomfort. This trend is reflected in the growing number of dental practices adopting advanced suturing methods that align with these patient preferences. As a result, the market for dental sutures is projected to expand, with estimates suggesting a growth rate of approximately 6.5% annually. The shift towards less invasive options not only enhances patient satisfaction but also drives innovation within the dental suture market, as manufacturers strive to develop sutures that cater to these evolving needs.

Leave a Comment