Growing Geriatric Population

The increasing geriatric population in South Korea presents a significant driver for the dental suture market. As individuals age, they often experience a higher incidence of dental issues, necessitating surgical interventions that require suturing. Projections indicate that the elderly population will constitute a larger segment of the overall demographic, leading to an uptick in dental procedures tailored to this age group. This trend suggests a sustained demand for durable and effective sutures that cater to the unique needs of older patients. The dental suture market is thus poised to expand in response to this demographic shift, ensuring that appropriate suturing solutions are available for the aging population.

Increasing Dental Procedures

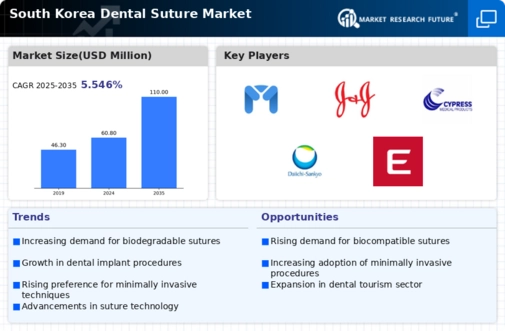

The rise in dental procedures in South Korea is a pivotal driver for the dental suture market. As the population becomes more health-conscious, there is a growing emphasis on oral health, leading to an increase in dental visits. According to recent statistics, dental procedures have surged by approximately 15% over the past few years. This trend is likely to continue, as more individuals seek preventive care and cosmetic enhancements. Consequently, the demand for effective suturing solutions is expected to grow, as dental professionals require high-quality materials to ensure optimal healing and patient satisfaction. The dental suture market is thus positioned to benefit from this increasing volume of dental interventions, necessitating a diverse range of suture options to cater to various surgical needs.

Rising Aesthetic Expectations

In South Korea, the cultural emphasis on aesthetics significantly influences the dental suture market. Patients increasingly seek cosmetic dental procedures, which often require suturing for optimal results. The demand for aesthetic dental solutions, such as gum contouring and dental implants, has been on the rise, with a reported increase of around 20% in cosmetic procedures. This trend indicates a shift towards more intricate dental surgeries, necessitating advanced suturing techniques and materials. As dental professionals strive to meet these aesthetic expectations, the dental suture market must adapt by providing innovative and aesthetically pleasing suture options that enhance the overall patient experience.

Government Initiatives and Support

Government initiatives aimed at improving healthcare access and quality in South Korea are likely to bolster the dental suture market. Policies promoting dental health awareness and preventive care are expected to increase the number of dental procedures performed. Furthermore, funding for dental education and training programs enhances the skills of dental professionals, leading to more complex surgical interventions. As a result, the demand for high-quality sutures is anticipated to rise. The dental suture market stands to benefit from these supportive measures, as they create an environment conducive to growth and innovation in dental practices.

Technological Innovations in Dentistry

Technological advancements in dental practices are transforming the landscape of the dental suture market. Innovations such as laser dentistry and minimally invasive surgical techniques are becoming more prevalent, leading to a demand for specialized sutures that accommodate these methods. The integration of technology in dental procedures has been linked to improved patient outcomes and reduced recovery times. As a result, the dental suture market is likely to see an increase in demand for sutures that are compatible with these advanced techniques. This shift not only enhances the efficiency of dental surgeries but also aligns with the growing trend of patient-centered care.

Leave a Comment