Focus on Patient-Centric Care

The dental suture market in France is increasingly influenced by a focus on patient-centric care. Dental practitioners are prioritizing patient comfort and satisfaction, which is leading to the adoption of sutures that minimize discomfort and promote faster healing. This shift towards a more holistic approach to dental care is prompting manufacturers to develop sutures that are not only functional but also enhance the overall patient experience. As a result, the market is likely to see a rise in demand for innovative suturing materials that align with these patient-centric values. This trend may contribute to a projected growth of around 5.5% in the dental suture market, as practitioners seek to improve patient outcomes and satisfaction.

Growing Awareness of Oral Health

In France, there is a growing awareness of oral health, which significantly impacts the dental suture market. As the population becomes more informed about the importance of dental care, there is an uptick in dental procedures, including surgeries that require suturing. This heightened awareness is likely to lead to an increase in dental visits, thereby driving the demand for sutures used in various dental applications. According to recent statistics, the dental care market in France is expected to reach €12 billion by 2026, indicating a robust growth trajectory. This surge in dental care activities necessitates a corresponding increase in the availability and variety of sutures, thereby benefiting the dental suture market.

Increase in Dental Insurance Coverage

The increase in dental insurance coverage in France is likely to have a positive impact on the dental suture market. As more individuals gain access to dental insurance, they are more inclined to seek dental treatments, including surgical interventions that necessitate suturing. This trend is particularly relevant in urban areas where insurance penetration is higher. With the French government promoting health insurance reforms, the dental sector is expected to witness a surge in patient inflow. Consequently, this could lead to an increased demand for various types of sutures, thereby driving growth in the dental suture market. Analysts predict that this trend could result in a market expansion of approximately 4% annually.

Technological Innovations in Dental Equipment

Technological innovations in dental equipment are transforming the landscape of the dental suture market in France. Advanced suturing devices and materials are being developed, enhancing the efficiency and effectiveness of dental procedures. Innovations such as automated suturing systems and smart sutures that can monitor healing are gaining traction among dental practitioners. These advancements not only improve surgical outcomes but also reduce the time required for procedures, which is appealing to both dentists and patients. The integration of technology in dental practices is expected to contribute to a growth rate of around 5% in the dental suture market, as practitioners seek to adopt the latest tools to enhance their service offerings.

Rising Demand for Minimally Invasive Procedures

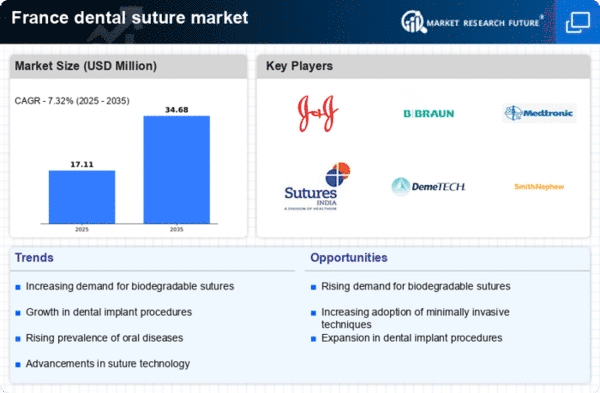

The dental suture market in France experiences a notable increase in demand for minimally invasive procedures. This trend is driven by patient preferences for less traumatic surgical options, which often result in quicker recovery times and reduced postoperative discomfort. As dental professionals adopt techniques that align with these preferences, the need for specialized sutures that facilitate such procedures becomes paramount. The market is projected to grow at a CAGR of approximately 6.5% over the next few years, reflecting the increasing inclination towards less invasive dental surgeries. Consequently, manufacturers are likely to innovate and develop sutures that cater specifically to these evolving surgical techniques, thereby enhancing their market presence in the dental suture market.

Leave a Comment