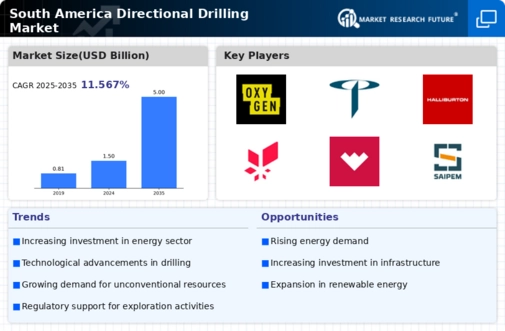

Rising Energy Demand

The increasing energy demand in South America is a primary driver for the directional drilling market. As countries in the region experience economic growth, the need for energy resources, particularly oil and gas, escalates. The International Energy Agency projects that energy consumption in South America could rise by approximately 30% by 2040. This surge in demand necessitates advanced drilling techniques, such as directional drilling, to access hard-to-reach reserves. The directional drilling market is likely to benefit from this trend, as companies seek efficient methods to maximize output while minimizing environmental impact. Furthermore, the region's diverse geological formations present unique challenges that directional drilling can effectively address, making it an attractive option for energy producers.

Technological Integration

The integration of advanced technologies in drilling operations is reshaping the directional drilling market in South America. Innovations such as real-time data analytics, automation, and improved drilling equipment are enhancing operational efficiency and safety. Companies are increasingly adopting these technologies to optimize drilling processes and reduce costs. For instance, the use of rotary steerable systems allows for more precise drilling, which is crucial in complex geological formations. The directional drilling market is likely to see a surge in demand for these advanced technologies, as operators seek to improve their competitive edge and meet the growing energy demands in the region. This technological evolution may also lead to enhanced environmental performance, aligning with global sustainability goals.

Investment in Infrastructure

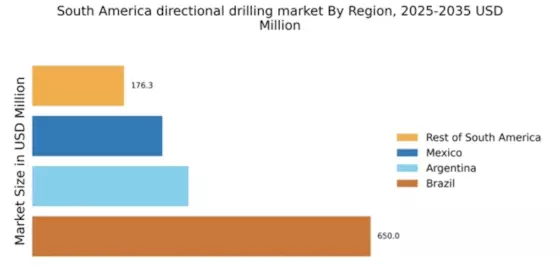

Investment in infrastructure development across South America is significantly influencing the directional drilling market. Governments and private entities are channeling substantial funds into enhancing energy infrastructure, including pipelines and drilling facilities. For instance, Brazil and Argentina have announced multi-billion dollar projects aimed at expanding their oil and gas sectors. This influx of capital is expected to create a favorable environment for the directional drilling market, as enhanced infrastructure facilitates the deployment of advanced drilling technologies. Additionally, improved transportation networks will likely reduce operational costs and increase efficiency, further driving the adoption of directional drilling techniques in the region.

Regulatory Support for Energy Sector

Regulatory support for the energy sector in South America is fostering growth in the directional drilling market. Governments are implementing policies that encourage exploration and production activities, particularly in oil and gas. For example, favorable tax incentives and streamlined permitting processes are attracting investments in drilling projects. This supportive regulatory environment is likely to stimulate the directional drilling market, as companies are more willing to invest in advanced drilling technologies. Additionally, as regulations evolve to address environmental concerns, the adoption of directional drilling techniques, which can minimize surface disruption, may become increasingly attractive to operators. This trend suggests a positive outlook for the directional drilling market in the region.

Exploration of Unconventional Resources

The exploration of unconventional resources, such as shale gas and tight oil, is a significant driver for the directional drilling market in South America. Countries like Argentina are investing heavily in their Vaca Muerta shale formation, which is estimated to hold vast reserves of oil and gas. The directional drilling market is poised to benefit from this trend, as these unconventional resources often require advanced drilling techniques to extract efficiently. The potential for high returns on investment in these areas is attracting both domestic and international players, leading to increased demand for directional drilling services. As exploration activities expand, the need for skilled labor and advanced technology in the directional drilling market will likely grow.