Research Methodology on Directional Drilling Market

Introduction

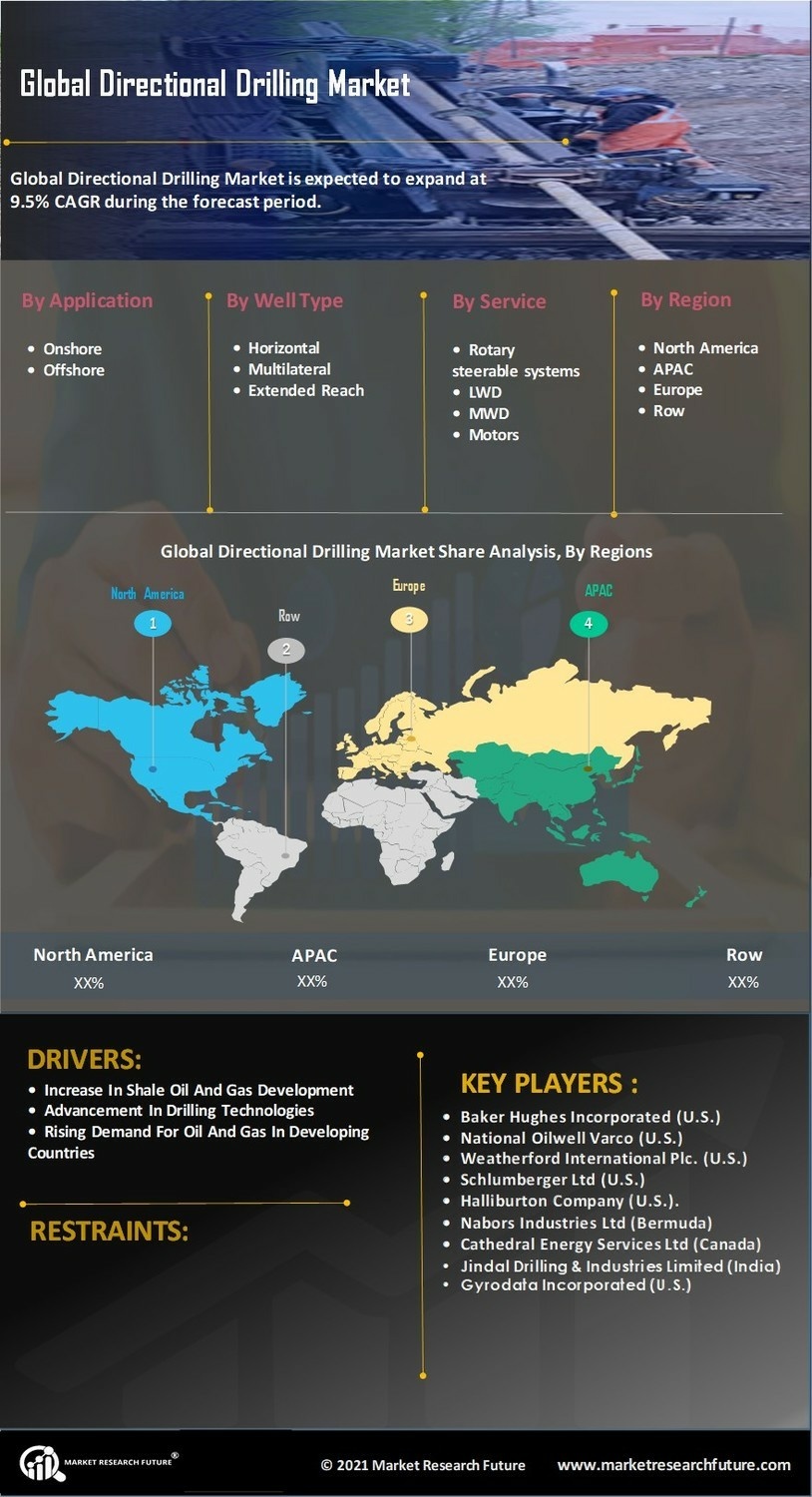

Directional drilling is the act of drilling a wellbore that is non-vertical to reach a particular geological target. Directional drilling technology is used to reach a specific horizontal location at a given depth. Directional drilling technology helps to reduce the environmental footprint of drilling operations, increase production and decrease the cost of operations.

Research Methodology

The research methodology employed for this report is designed in two ways- primary and secondary. The primary research method covers extensive interviews of industry experts and opinion leaders and with key decision makers and influencers whereas secondary research includes extensive internet browsing, stock exchange trends, and past research works and is also focused on market analysis published by standard authors, websites, company magazines, books and monthly journals.

For the purpose of primary research, an exhaustive set of interviews is conducted that includes-

- End-Users: Oil & Gas producers & service providers, Conductor and Casing Chemical Market, Oilfield Chemicals Market

- Technical specialists and Senior Managers of the industries

- Key Opinion Leaders

Information obtained from these interviews is validated by Trade Associations, Company Websites and through Paid Databases.

The Secondary research entails the use of multiple sources such as public sources (mostly paid for) such as Frost & Sullivan reports, as well as other sources such as market research reports, press releases, articles, library references, public domain information and trade reports.

The primary and secondary research results are further cross-checked to validate their reliability and correctness. In conclusion, this ensures a comprehensive and in-depth research report, where the data from both primary and secondary research are compiled together and a comprehensive market analysis is acquired.

Statistical Analysis

For the report, extensive statistical analysis is employed which applies qualitative and quantitative methods of analysis to evaluate the market. Quantitative analysis is focused on the evaluation and measurement of data collected through primary and secondary research activities. To ensure the accuracy of quantitative analysis, measures such as correlation, linear regression and time series have been utilized. Qualitative analysis helps in understanding the market trends, factors and dynamics. The qualitative analysis enables an in-depth analysis of the trend in the Directional Drilling market.

Data Triangulation

Data triangulation is one of the primary trends used to validate the data collected for the market. Data is gathered through interviews, surveys and desk research processes and is further validated utilizing secondary research activities. In conclusion, all the data compiled is kept consistent and carefully verified to maintain accuracy in the study.

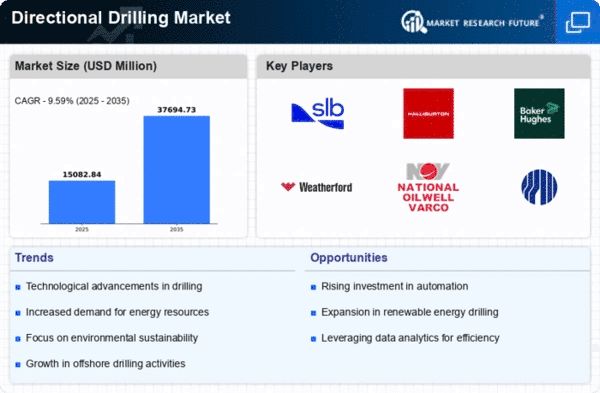

Market Size Estimation

The market size estimation for the Directional Drilling Market is obtained through the hypothesis of top-down and bottom-up approaches. The parameters obtained from the research study such as market share and value correspond to the parameters for stratification and market size estimation.

The recent and forecast market data for the various categories such as type, application, technology and region correlates to the growth rate of the market. The top-down and bottom-up approaches are used to calculate the revenue estimation and to provide an accurate estimate of the size of the global Directional Drilling market.

Data Analysis

The data collected is studied and analyzed to conclude. It is observed that the market size would continuously increase in the coming years with the increasing market opportunities and technological advancements, which will fulfil the growing demands for the market all over the world. The collected data is also analyzed, to understand the recent trends, drivers and restraints affecting the market.

Conclusion

With the ever-increasing demand for oil & gas production, the Directional Drilling process is being widely used in the field. This process has been an effective way to reach further depths and increase the production rate. The research included in this report provides a detailed outlook of the Directional Drilling market and its growth over the review period i.e. 2023 to 2030. It covers market size, share and value analysis, growth opportunities and factors, competitive analysis, strategic analysis and other key market segments.