Rising Data Traffic

The surge in data traffic across South America is a primary driver for the edge data-center market. With the increasing adoption of digital services, the demand for data processing and storage capabilities has escalated. In 2025, data traffic in the region is projected to grow by approximately 30%, necessitating the establishment of edge data centers to ensure efficient data handling. This growth is largely attributed to the proliferation of mobile devices and high-definition content consumption. As businesses and consumers alike demand faster and more reliable access to data, the edge data-center market is positioned to expand significantly, providing localized solutions that reduce latency and enhance user experience.

Expansion of 5G Networks

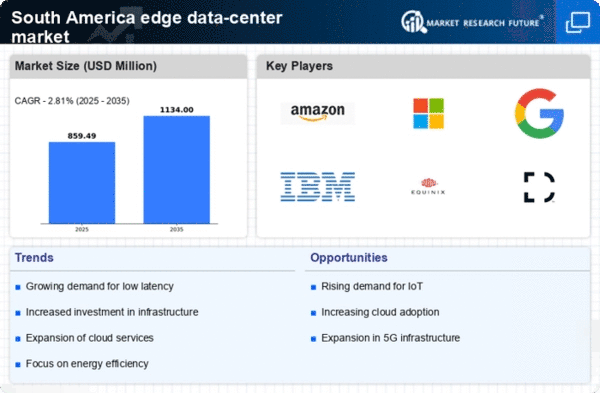

The rollout of 5G networks across South America is poised to revolutionize the edge data-center market. With 5G technology offering speeds up to 100 times faster than 4G, the need for edge data centers becomes increasingly critical. By 2025, it is estimated that 5G subscriptions in the region will reach over 100 million, driving the demand for low-latency applications. This technological advancement enables real-time data processing, which is essential for applications such as autonomous vehicles and smart cities. Consequently, the edge data-center market is likely to experience substantial growth as businesses seek to leverage the capabilities of 5G to enhance their operational efficiency and service delivery.

Emergence of Smart Cities

The development of smart cities in South America is a pivotal driver for the edge data-center market. As urban areas increasingly integrate technology to improve infrastructure and services, the demand for real-time data processing becomes critical. By 2025, it is estimated that investments in smart city initiatives will exceed $50 billion in the region. This trend necessitates the deployment of edge data centers to support applications such as traffic management, public safety, and energy efficiency. Consequently, the edge data-center market is likely to flourish as municipalities and private enterprises collaborate to create intelligent urban environments that rely on localized data processing.

Adoption of Cloud Services

The growing adoption of cloud services in South America is significantly impacting the edge data-center market. As businesses increasingly migrate to cloud-based solutions, the need for edge data centers to support these services becomes apparent. In 2025, the cloud services market in the region is projected to reach $10 billion, with a substantial portion of this growth driven by small and medium-sized enterprises. These businesses require reliable and efficient data processing capabilities, which edge data centers can provide. The edge data-center market is thus expected to expand as organizations seek to optimize their cloud strategies and enhance their operational agility.

Increased Focus on Data Sovereignty

Data sovereignty has emerged as a crucial concern for businesses operating in South America, influencing the edge data-center market. Governments in the region are implementing regulations that require data to be stored within national borders, thereby driving the demand for localized data centers. By 2025, it is anticipated that over 60% of companies will prioritize compliance with these regulations, leading to a surge in the establishment of edge data centers. This trend not only addresses legal requirements but also enhances data security and privacy for consumers. As a result, the edge data-center market is likely to see increased investment and development in infrastructure to meet these regulatory demands.