Expansion of Medical Tourism

The expansion of medical tourism in South America is emerging as a crucial driver for the endoscopic retrograde-cholangiopancreatography market. Countries like Costa Rica and Mexico are becoming popular destinations for patients seeking affordable and high-quality medical care, including endoscopic procedures. The cost-effectiveness of treatments in these regions, often significantly lower than in North America and Europe, is attracting international patients. As a result, healthcare facilities are enhancing their capabilities to cater to this influx, which includes investing in advanced endoscopic technologies. It is estimated that medical tourism could contribute to a 15% increase in the number of endoscopic retrograde-cholangiopancreatography procedures performed annually, thereby bolstering market growth.

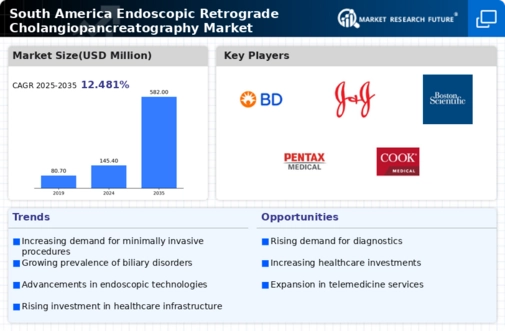

Increasing Healthcare Expenditure

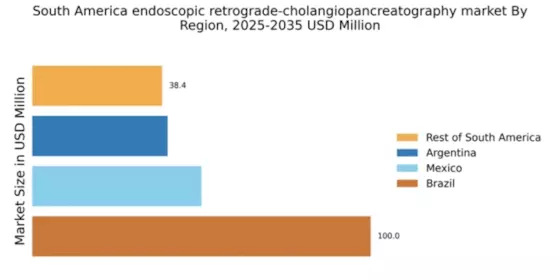

The rising healthcare expenditure in South America is a pivotal driver for the endoscopic retrograde-cholangiopancreatography market. Governments and private sectors are investing more in healthcare infrastructure, which enhances the availability of advanced medical technologies. For instance, countries like Brazil and Argentina have reported an increase in healthcare budgets, allowing for the procurement of sophisticated endoscopic equipment. This trend is expected to continue, with healthcare spending projected to grow at a CAGR of approximately 5% over the next few years. As a result, hospitals and clinics are more likely to adopt endoscopic retrograde-cholangiopancreatography procedures, thereby expanding the market. Furthermore, increased funding for healthcare initiatives is likely to improve patient access to these essential diagnostic and therapeutic procedures.

Growing Awareness of Gastrointestinal Health

There is a notable increase in awareness regarding gastrointestinal health among the South American population, which is significantly influencing the endoscopic retrograde-cholangiopancreatography market. Public health campaigns and educational programs are being implemented to inform individuals about the importance of early diagnosis and treatment of biliary disorders. This heightened awareness is leading to more patients seeking medical attention for gastrointestinal issues, thereby increasing the demand for endoscopic procedures. According to recent surveys, approximately 60% of the population in urban areas are now aware of the benefits of endoscopic retrograde-cholangiopancreatography. This trend is likely to drive market growth as more healthcare providers are encouraged to offer these services to meet the rising patient demand.

Rising Incidence of Obesity and Related Disorders

The increasing prevalence of obesity and related disorders in South America is contributing to the growth of the endoscopic retrograde-cholangiopancreatography market. Obesity is a known risk factor for various biliary disorders, which necessitates the need for effective diagnostic and therapeutic interventions. Recent studies indicate that approximately 30% of the adult population in South America is classified as obese, leading to a higher incidence of conditions such as gallstones and pancreatitis. This trend is likely to drive demand for endoscopic retrograde-cholangiopancreatography as healthcare providers seek to address these complications. Consequently, the market is expected to expand as more patients require these procedures for diagnosis and treatment.

Technological Integration in Healthcare Facilities

The integration of advanced technologies in healthcare facilities across South America is a significant driver for the endoscopic retrograde-cholangiopancreatography market. Hospitals are increasingly adopting digital solutions, such as electronic health records and telemedicine, which facilitate better patient management and streamline the workflow for endoscopic procedures. The introduction of AI and machine learning in diagnostic processes is also enhancing the accuracy and efficiency of endoscopic retrograde-cholangiopancreatography. As a result, healthcare facilities are likely to see improved patient outcomes and operational efficiency. Market analysts suggest that the adoption of these technologies could lead to a 20% increase in the number of procedures performed annually, thereby positively impacting the market.